Table of Contents

The data in our new Digital 2022 October Global Statshot Report–published in partnership with Hootsuite and We Are Social–covers the outlook for Facebook in the months ahead, valuable perspectives on the growth of the metaverse, changes at the top of a key social media ranking, intriguing trends in TikTok behavior, and more.

If you’re looking to understand what the world is really doing online, the good news is that you’re in the right place—simply read on below.

Top 10 takeaways

If you’re short on time, the YouTube video below will guide you through 10 of the top stories in this quarter’s data.

However, read on below that for our complete October report, and for my comprehensive analysis of this quarter’s key insights and trends.

And with this being our last report of 2022, I’ll finish up this quarter’s analysis with my take on the key themes and trends that I believe will shape and define digital success in 2023.

Just before we dive into all of those stories though, please read the following notes carefully, to ensure that you understand how recent changes in underlying data and research methodologies may impact this quarter’s findings.

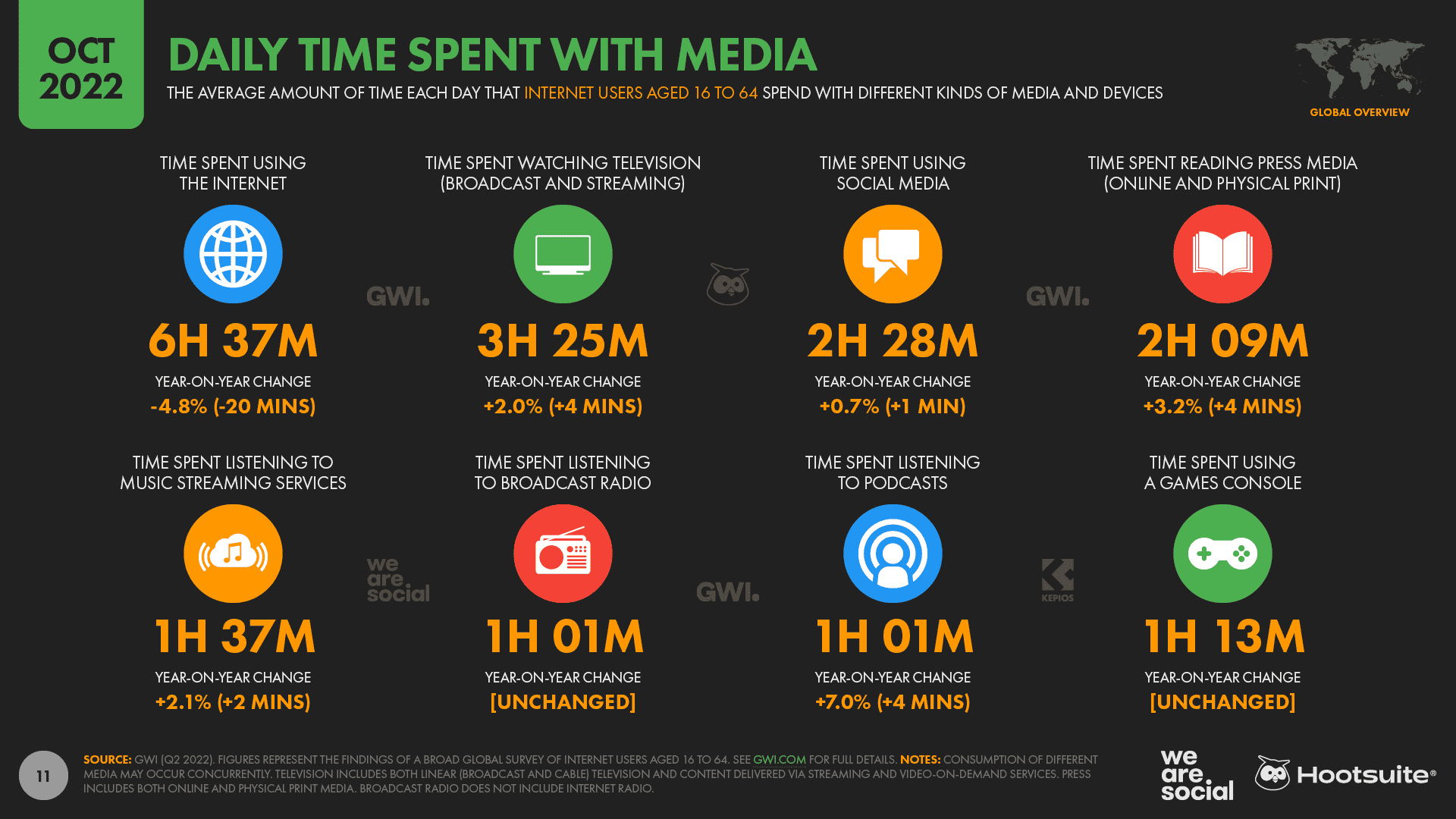

There’s an overall decline in the time we spend online, but that doesn’t necessarily mean that the internet is losing importance in our lives.

Even at the current average of 397 minutes per day, the typical global internet user still spends more than 40% of their waking life online.

GWI’s research and analysis indicate that people are trying to become more “purposeful” in their use of the internet, especially after the rapid rise in time spent using social media during COVID-19 lockdowns.

As Tom Morris, Trends Manager at GWI, told us in a recent interview,

“We believe that the world has effectively reached a “saturation point” for time spent using the internet. In recent months, average daily time spent has actually decreased worldwide, across all generations, and even in internet growth markets like the Middle East and Latin America. We believe this is mostly the result of increasing mistrust in the news and rising social media-induced anxiety, especially as social media accounts for an increasingly prominent share of overall online time.”

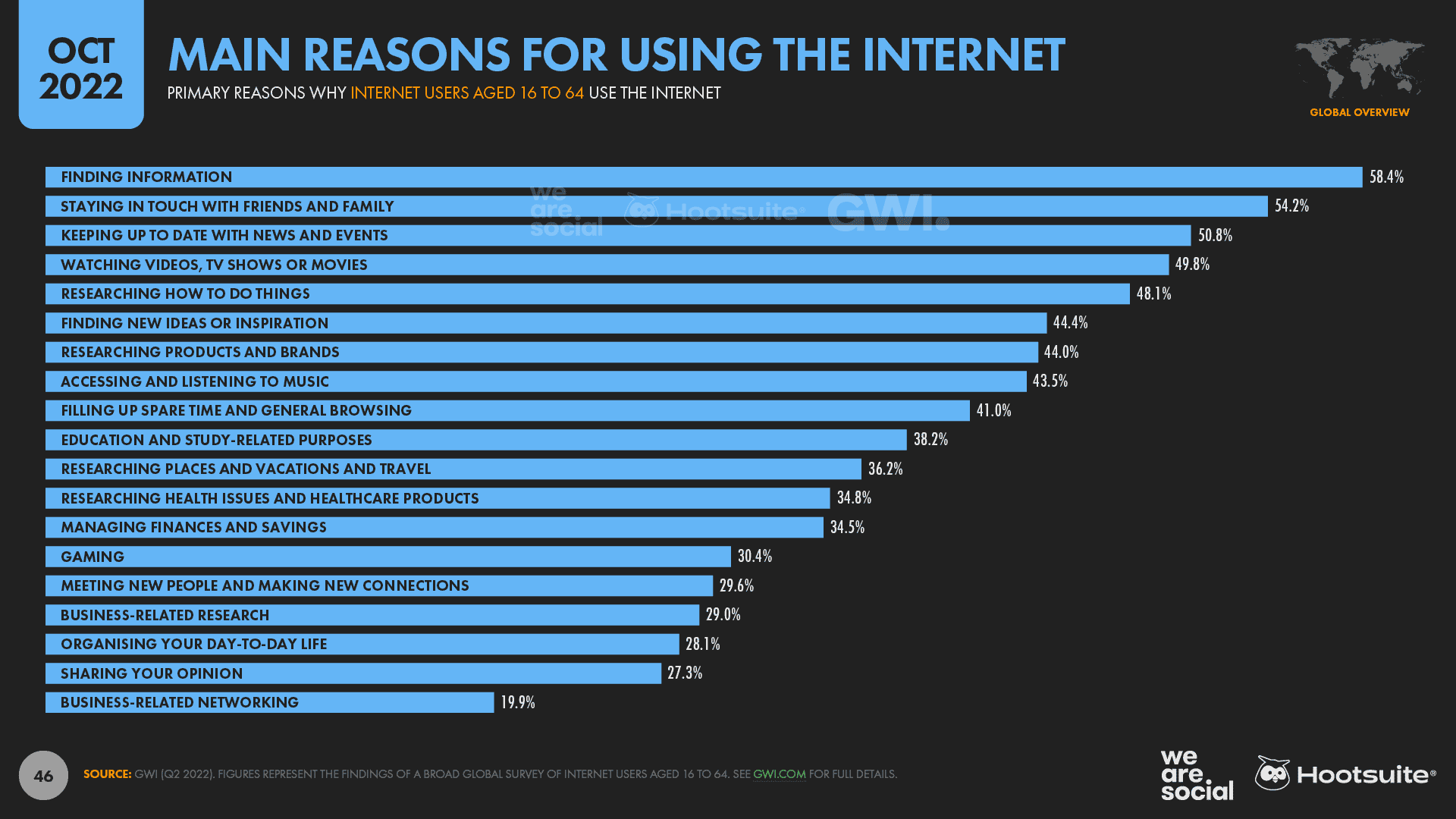

It’s also interesting to note that—while people’s motivations for using the internet haven’t changed much since the pre-COVID era—the number of people who choose each option in GWI’s survey has declined across all options.

Once again, this change suggests that people may be more “selective” in how they spend their time online, hinting at a more considered and purposeful approach to using connected tech.

So what does all of this mean for marketers?

Well, the key takeaway here is that we also need to be more purposeful, ensuring that our marketing activities and content actively add value to our audiences’ online experiences.

In particular, marketers need to be particularly conscious of adding value when they use interruptive ad formats—especially when it comes to the content we add to people’s social media feeds.

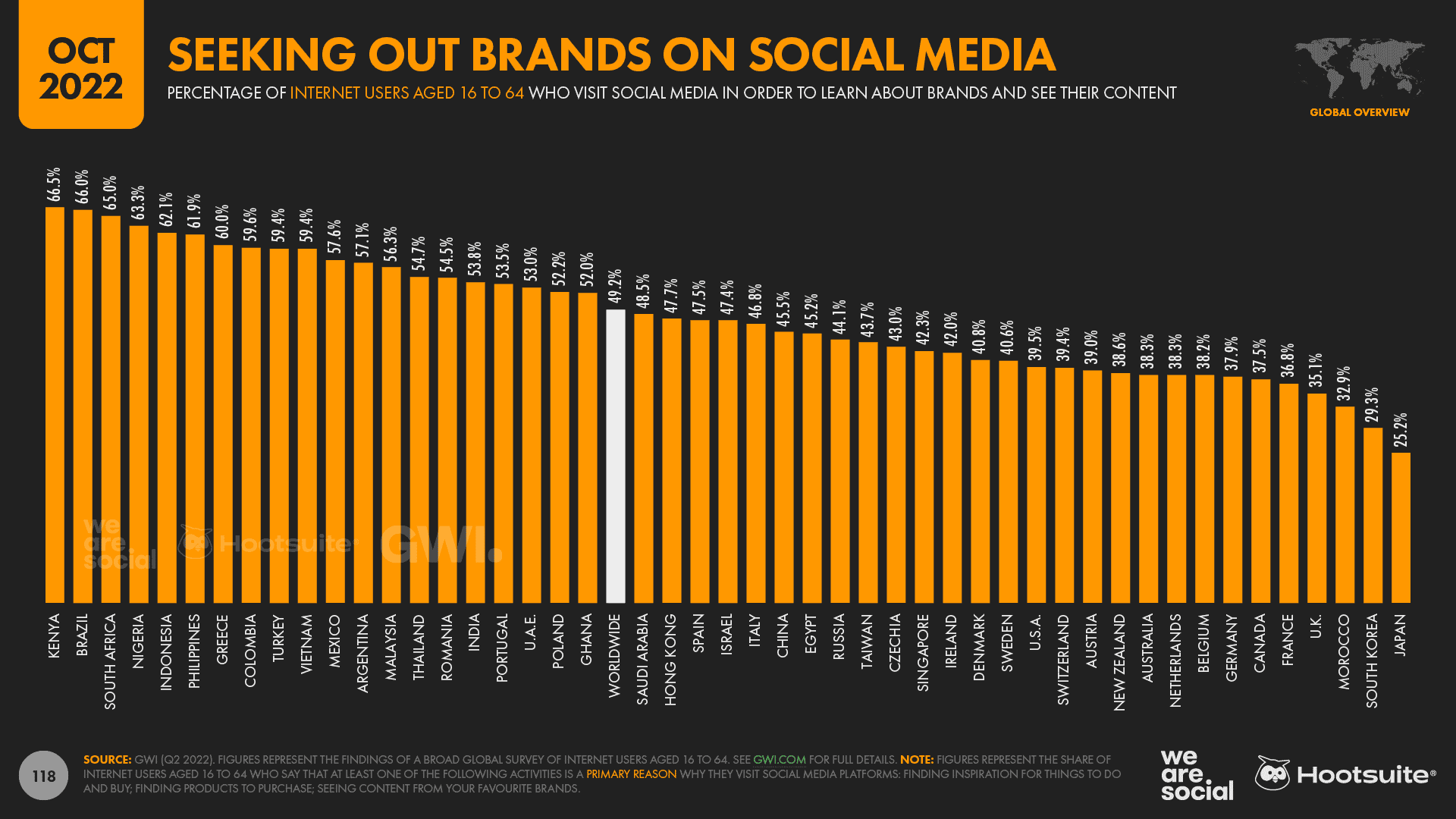

On the one hand, the latest data reveals that roughly half of all working-age internet users actively visit social platforms to learn about brands, and to research products and services that they’re considering buying.

However, with people becoming more thoughtful about where and how they spend their online time —especially in social media—it’s essential that brands don’t risk irritating their audiences with irrelevant content.

Furthermore, with many marketers facing budget cuts due to the challenging economic outlook, it’s never been more important for us to ensure that our investments in media and content deliver tangible value—both to audiences, and to the brand’s bottom line.

Meta revises its numbers… again

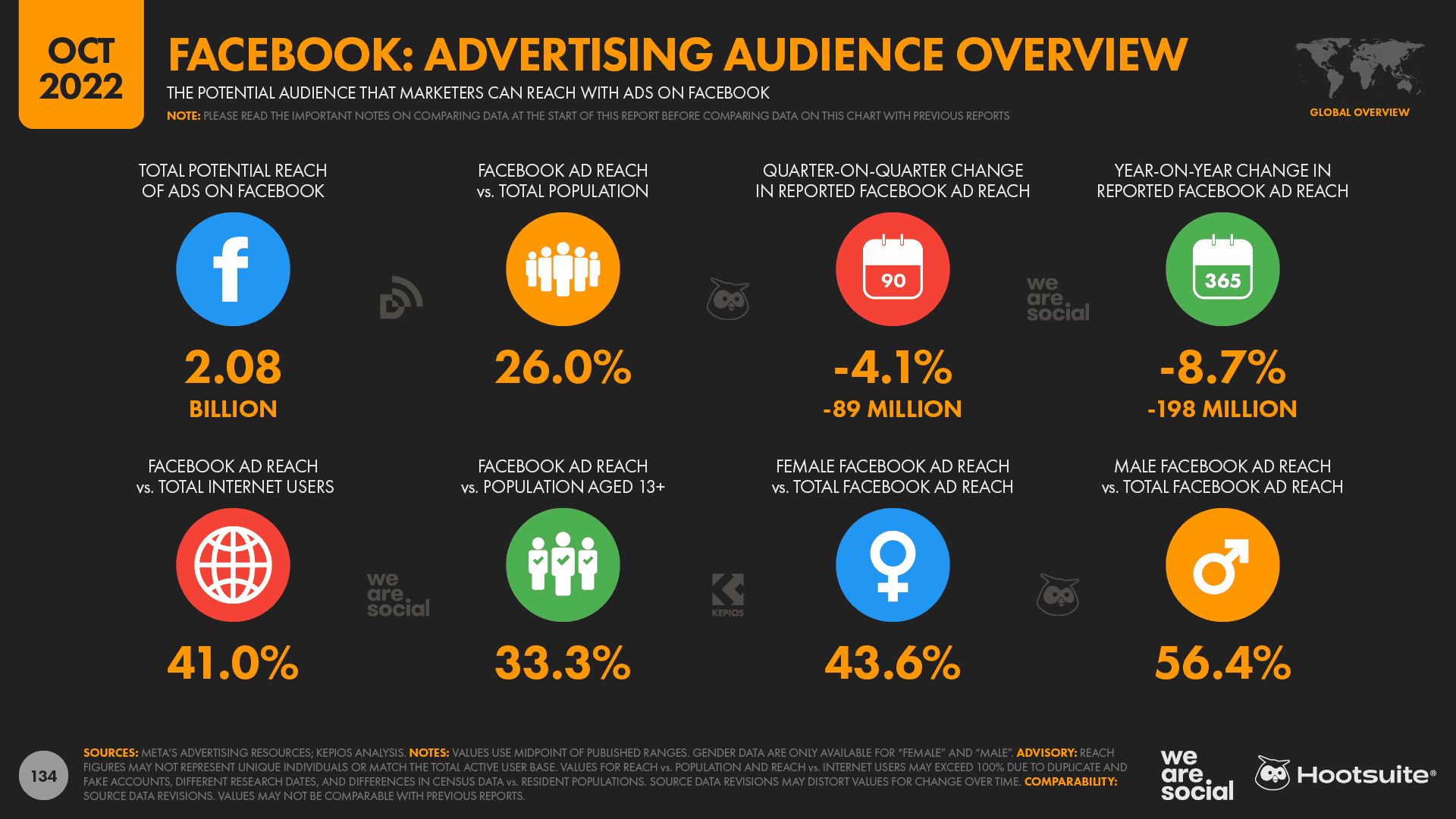

Meta appears to have made yet more revisions to its advertising audience reach figures.

The latest numbers published in the company’s ad planning tools are significantly lower across all three of its advertising-focused platforms, even compared with the numbers that appeared in the same tools just 3 months ago:

- Facebook: -4.1% vs. July 2022, equating to a drop of 89 million users

- Instagram: -3.8% vs. July 2022, equating to a drop of 54 million users

- Facebook Messenger: -2.4% vs. July 2022, equating to a drop of 24 million users

- Combined reach across all platforms and the Audience Network: -5.5% vs. July 2022, equating to a drop of 161 million users

These revisions aren’t uncommon though—especially at this time of year—and we’ve seen the company make similar revisions to its reach numbers on numerous occasions over the past decade.

However, we’ve noticed that such revisions have become more frequent over recent months, and the company appears to have revised its figures for Instagram at least twice since the start of 2022.

Moreover, this is the first time that we’ve seen the company revise figures for all of its platforms at the same time.

Historically, we’ve avoided reporting figures for change over time when we’ve detected these kinds of revisions, because the subsequent change in published figures doesn’t necessarily correlate with an actual drop in “genuine” reach.

For example, these revisions may reflect a purge of duplicate and “fake” accounts, and as such, a drop in reported reach doesn’t necessarily mean that marketers can reach fewer ‘real’ people in their target audiences.

However, given the scale and frequency of recent revisions, we’ve decided to publish these change figures from hereon, in order to help marketers make better informed decisions.

This is partly because the potential global Facebook ad reach figure published in the company’s tools is now lower than the figure that the same tools reported this time four years ago.

In October 2018, Meta’s planning tools reported potential global Facebook ad reach of 2.091 billion, but the same metric stands at just 2.079 billion today.

The outlook for Facebook

However, it’s unlikely that recent changes in Meta’s reported ad reach will correlate with equivalent drops in monthly active users (MAUs).

The company did announce a drop in monthly active user figures in its Q2 earnings announcement, and Zuck and team may well announce a similar trend in the company’s next investor update.

But the decline in Facebook’s MAUs between April and June 2022 only amounted to 2 million users, which equated to a drop of just 0.1% of the global total—considerably less than the 4.1% decline in reported ad reach over the same period.

Based on the size of this difference, my assessment is that changes in reporting methodology are likely to be the main factor contributing to the recent drop in Meta’s reported ad reach, rather than a sudden drop in its active user numbers.

Guidance in the company’s ad planning tools reinforce this hypothesis, with a pop-up note next to reported ad reach figures now stating that this metric is “in development”:

“An in-development metric is a measurement that we’re still testing. We’re still working out the best way to measure something, and we may make adjustments until we get it right.”

The note goes on to clarify why existing metrics like ad reach might be re-classified as “in development”:

“We frequently launch new features and new ways of measuring how those features perform. Sometimes we publish these metrics even when the way we calculate them isn’t final to get more feedback, make them better and figure out the best way to measure performance.”

However, regardless of the cause, the latest figures are still considerably lower than the potential reach that Meta’s tools reported just a few months ago.

As a result, marketers should carefully review the latest ad reach numbers for their brands’ specific audiences, in order to understand and quantify what paid media activities might deliver.

It’s also important to highlight that the figures for potential ad reach published in Meta’s planning tools are largely influenced by the number of people who were shown ads on its various platforms over the preceding 30 days.

As a result, it’s worth considering that any drop in reported potential reach may also be influenced by the number of advertisers buying ads on Meta’s platforms, and also the scale of their media spend.

For example, a drop in the number of advertisers—or in the amount that those advertisers spend on each platform—might result in fewer users seeing ads on Meta’s platforms, which in turn might affect the potential reach figures that the company’s tools report.

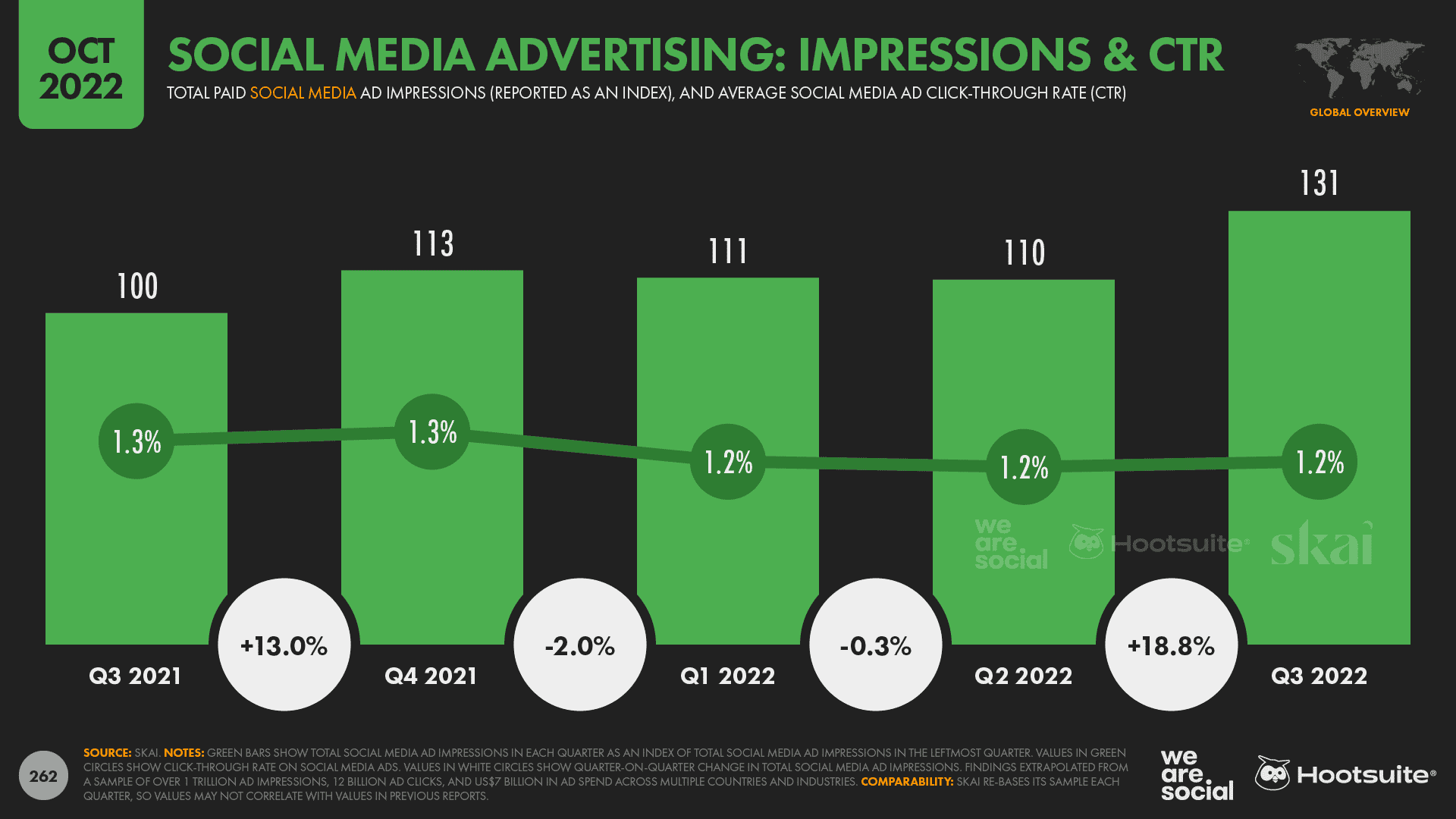

However, the latest data from Skai suggests that marketers actually spent more on social media ads in Q3 2022 versus Q2.

Moreover, average social media CPMs (the cost to deliver 1,000 social media as impressions) actually fell over the past 3 months, so that increased investment resulted in an 18.8% increase in the number of social media ads that were shown to users across all social platforms.

As a result, if the decline in reported reach across Meta’s various platforms were to have been affected by the number of advertisers and size of their investments, this might point to a decline in Meta’s share of the overall social media advertising market.

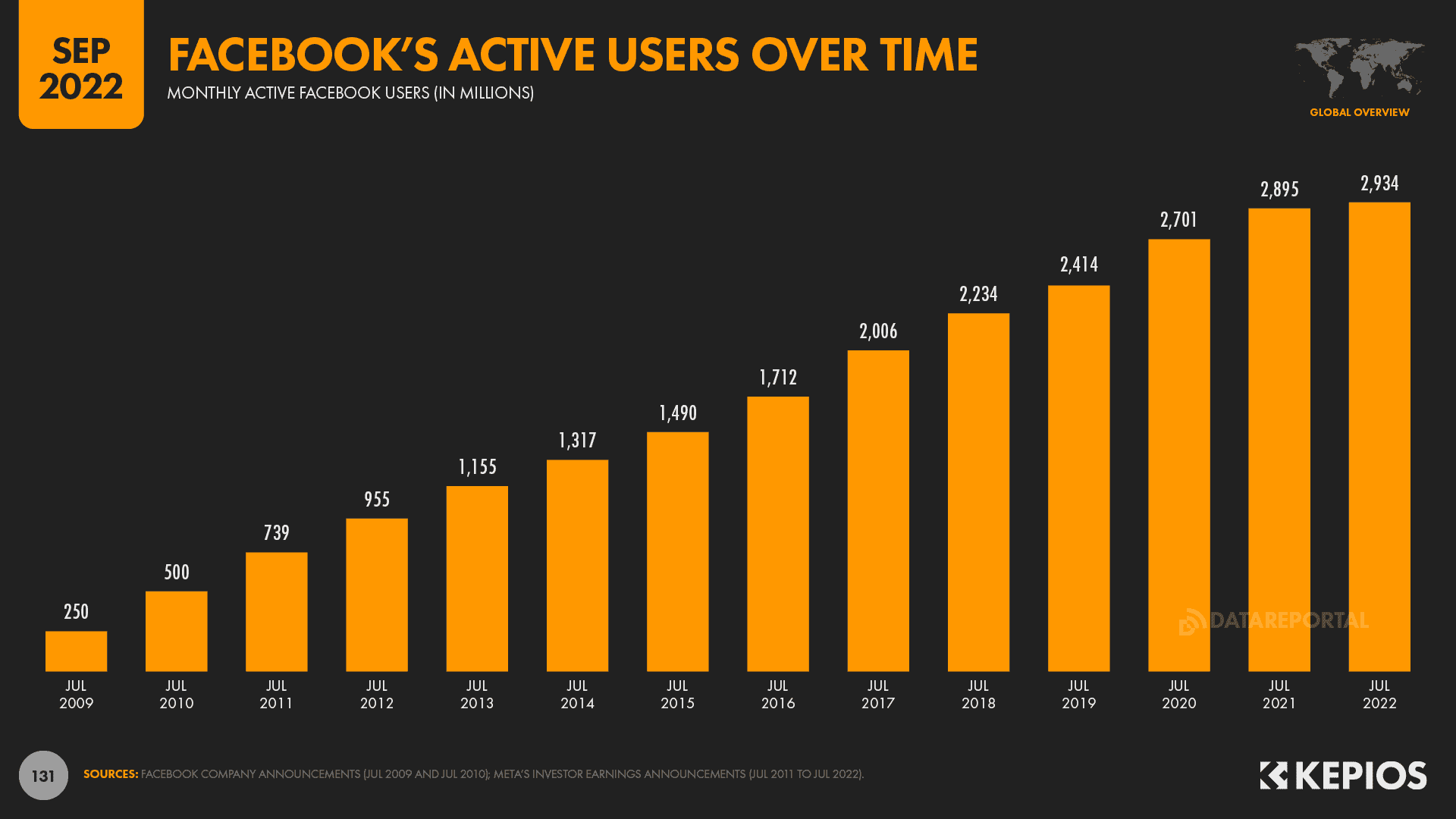

Facebook isn’t dying

Spoiler alert: no.

Investors and marketers alike will want to keep a careful watch on how these numbers evolve, but it’s important to stress that Facebook is still far from “dead”.

For clarity, media hyperbole relating to a purported “imminent demise” of Facebook is nothing new, and a New York Times headline decried a “Facebook Exodus” way back in August 2009.

Since then – even after the recent dip in global MAUs – Facebook’s active user base has grown by a factor of more than 10.

Despite those impressive growth figures, however, barely a week goes by without another click-bait headline delivering a dubious reading of the data.

Sure, there’s plenty to keep the team at Mountain View awake at night, from declining use amongst teenagers in its most valuable market, to ongoing regulatory issues.

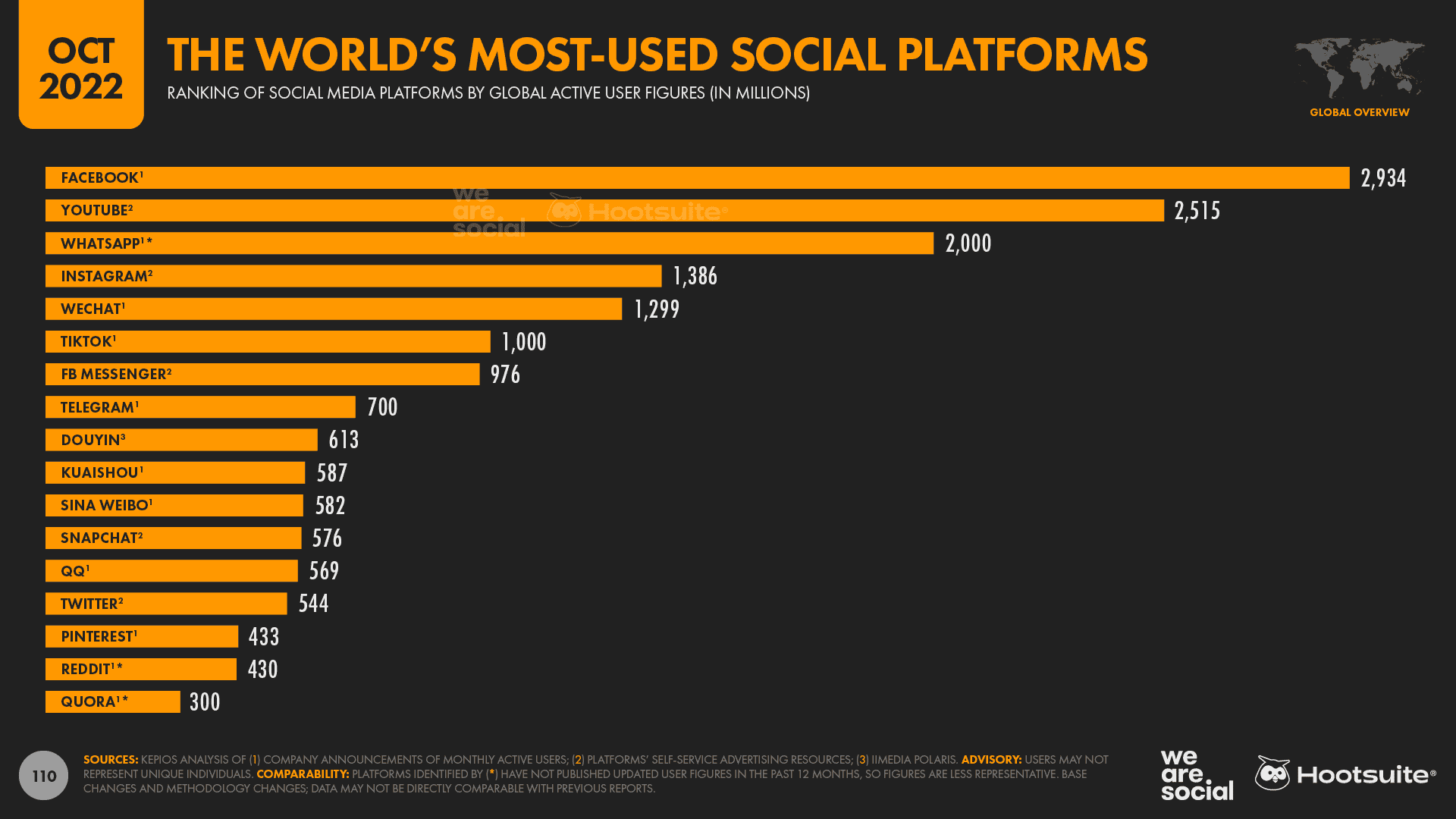

However, Facebook is still by far the world’s most used social media platform, and the available data suggest that it still has hundreds of millions more active users than its next nearest rival.

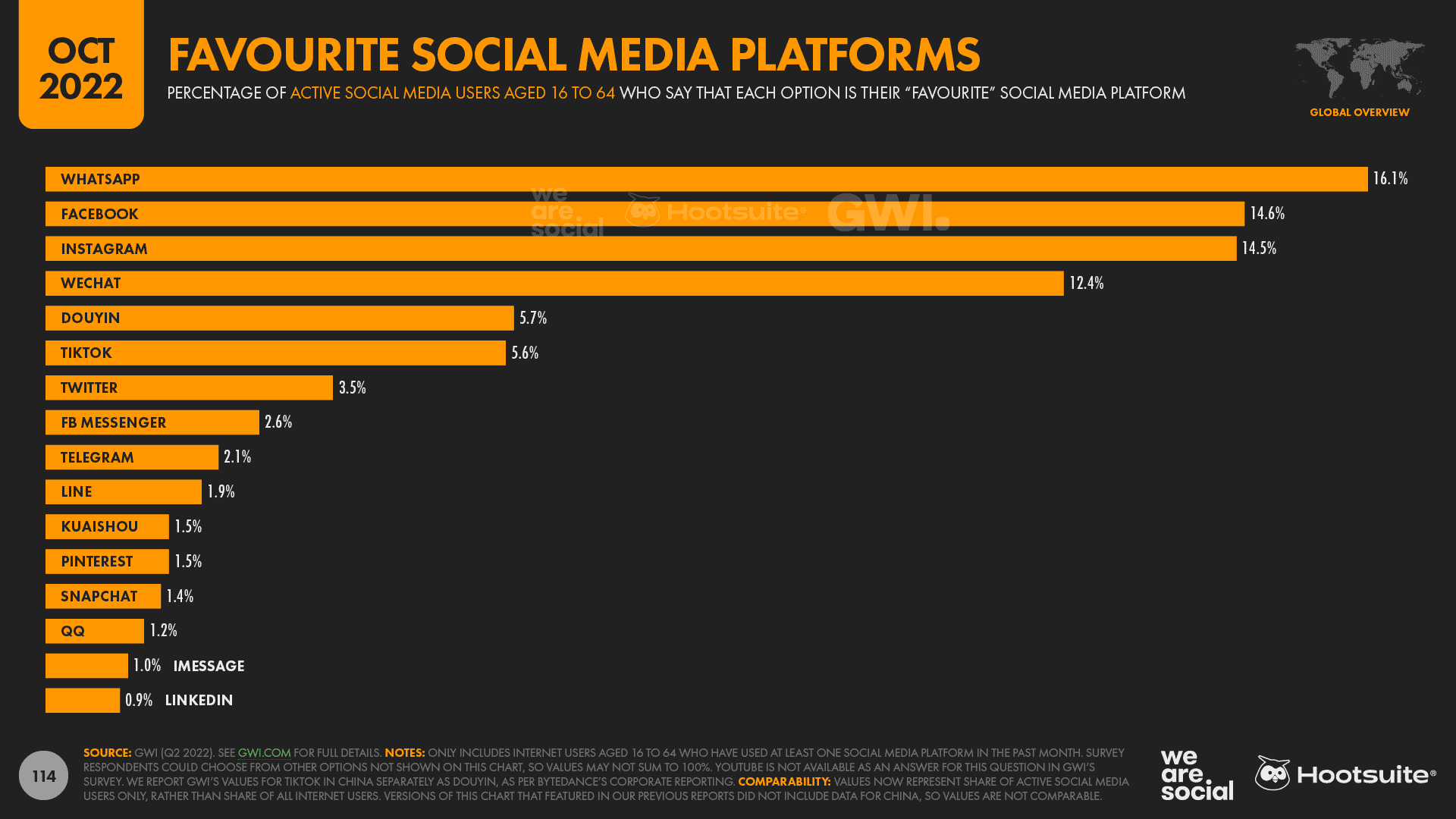

Meanwhile, Meta still accounts for all three of the world’s “favourite” social media platforms, and—crucially – people are still two-and-a-half times more likely to choose Facebook as their favourite social platform as they are to choose TikTok.

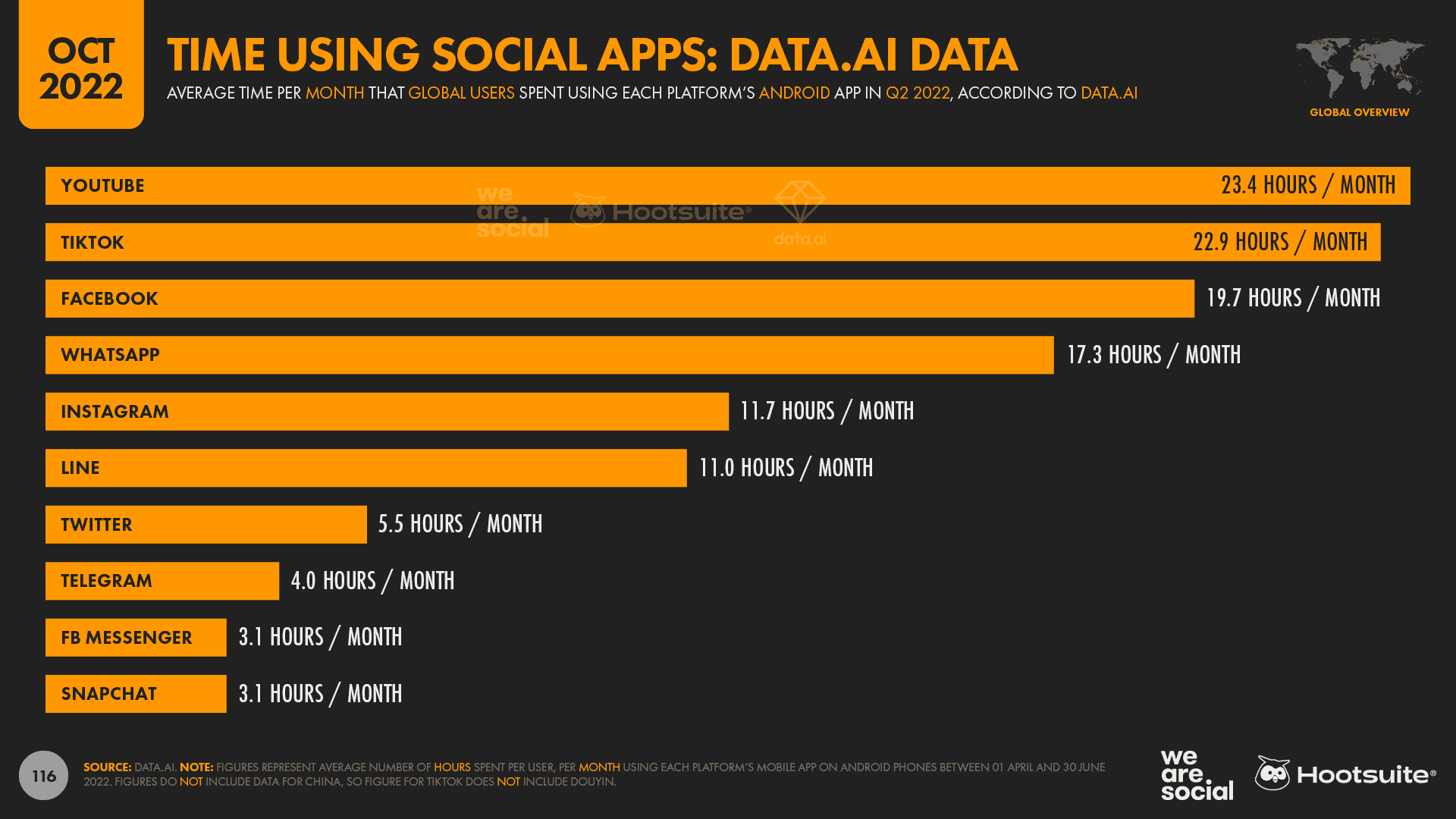

Moreover, analysis from data.ai reveals that the amount of time that the typical user spends using the Facebook app has actually increased over recent months, up from an average of 19.4 hours per month in Q1 2022, to an average of 19.7 hours per month in Q2.

But what about the future?

Well, even if Meta were to announce further declines in active user numbers over the coming months, it would likely take many years – and perhaps even decades – before Facebook actually “dies”.

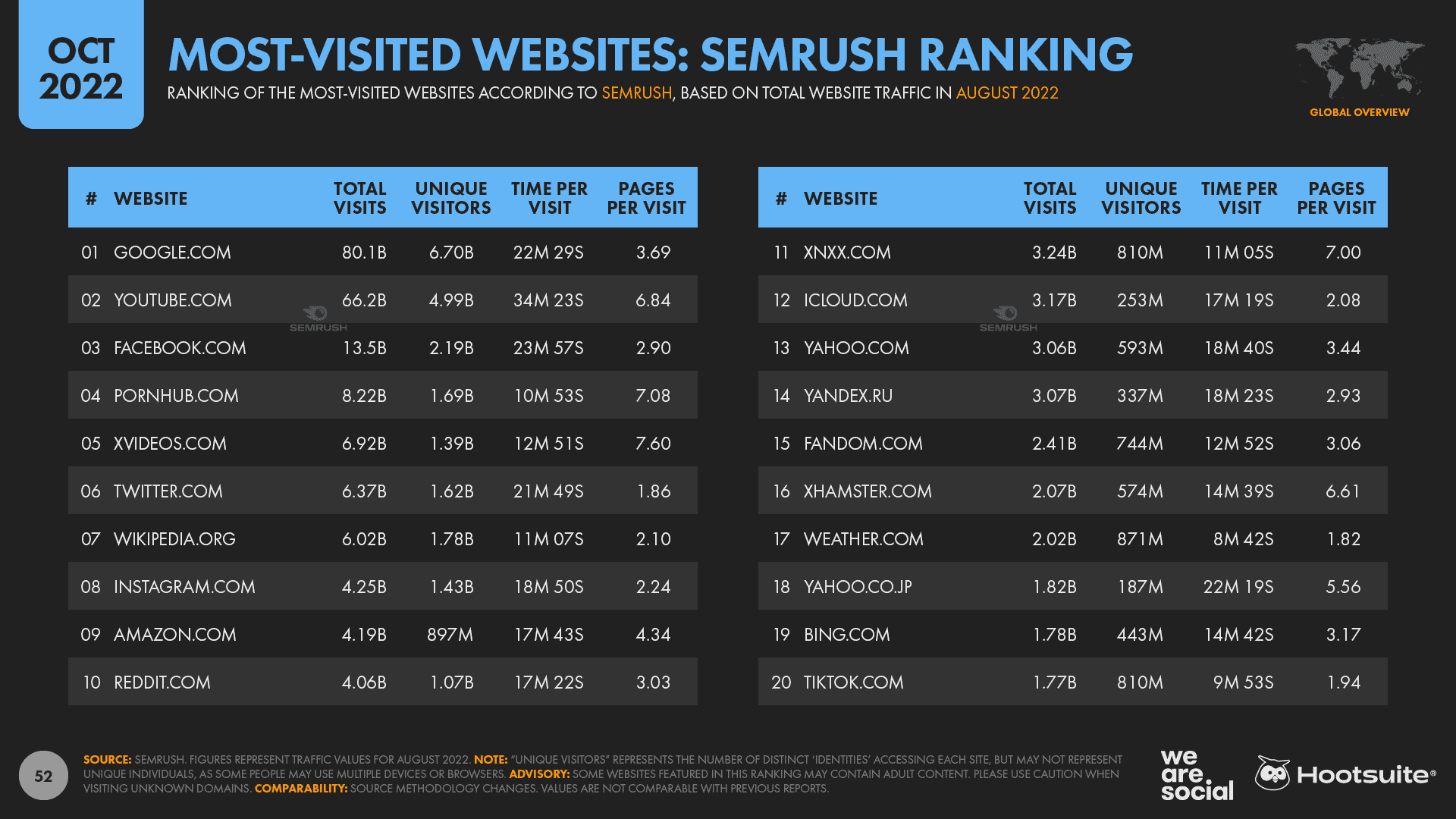

For context, data from Semrush reports that well over half a billion people still visit Yahoo! each month, despite the platform all but disappearing from media headlines over recent years.

Based on these Yahoo! trends, we can expect Facebook to continue attracting an audience of billions for the foreseeable future.

And as a result, you can rest assured that Facebook will continue to offer valuable marketing opportunities well beyond the horizon of even your most forward-looking media plan.

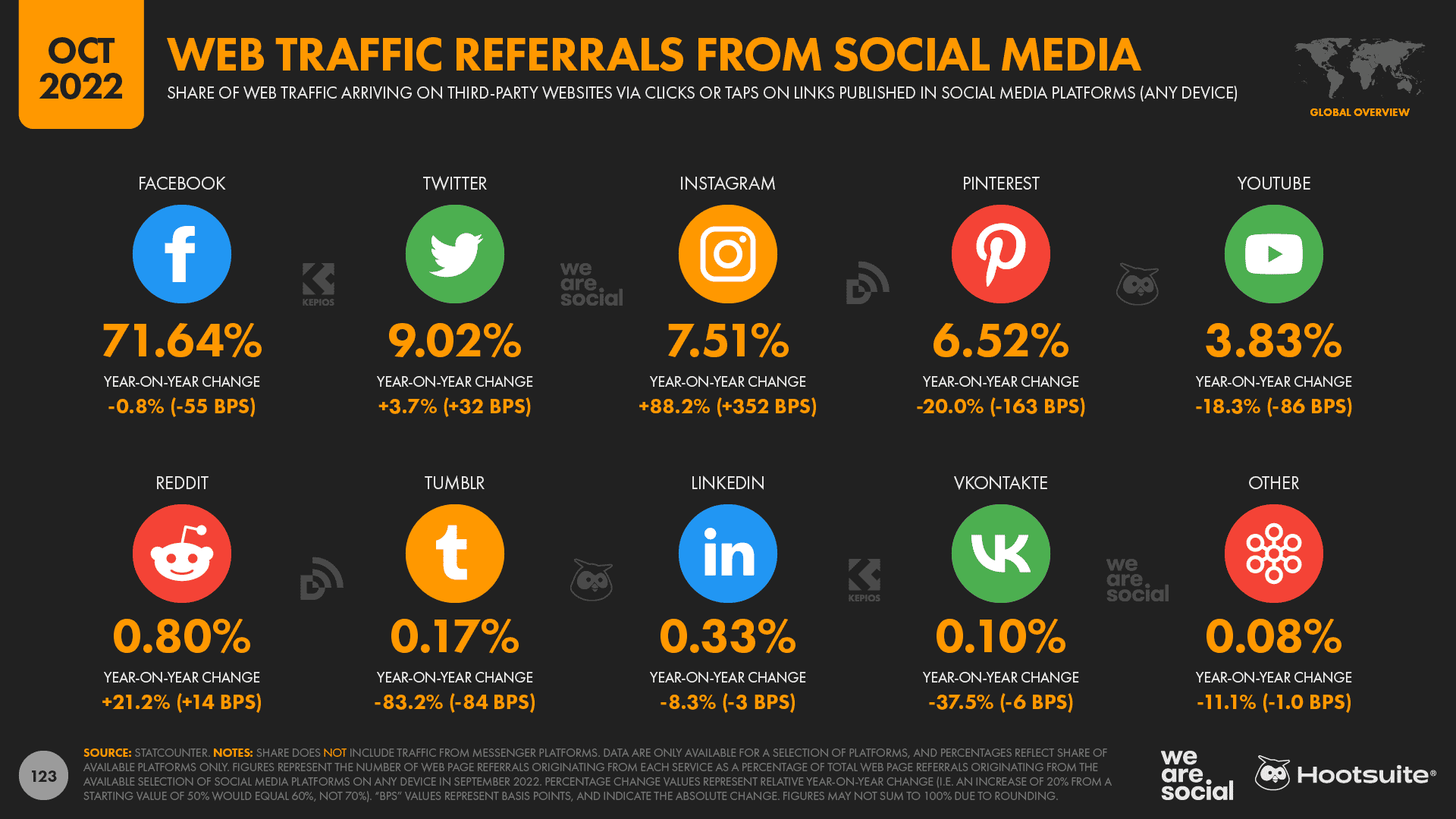

And if you’re still not convinced about that, take a look at these latest figures from Statcounter, which show that Facebook is still responsible for more than 70% of all web traffic referrals that originate from social media.

How Facebook stacks up to TikTok

But while we’re on the subject of how headlines can distort our perspective, let’s compare Facebook’s latest numbers with some other platforms that seem to be current media darlings.

To be clear, I’m not advocating for Facebook here; I simply want to provide some objective perspective.

Firstly, numbers reported in each company’s ad planning tools indicate that marketers can still reach twice as many adults aged 18 and above with ads on Facebook as they can with ads on TikTok.

Sure, the figures for teens might look a bit different, but Bytedance’s tools don’t report data for users below the age of 18, so it’s difficult to know for sure.

Moreover, if you’re not actively targeting teenagers, trends amongst younger users offer little more than trivia, and—as a marketer – you’d do better to focus your attention on what your specific audiences are actually doing today.

Next up, BeReal.

Yes, the platform is generating lots of buzz, and yes, the platform appears to be growing quickly.

Indeed, data from Sensor Tower reveals that—since launching just 2 years ago – the app has been installed on a cumulative total of 53 million smartphones.

However, it’s important to stress that this figure doesn’t equate to active users, and figures from August 2022 suggest that the app currently sees just 10 million daily active users.

And even if that number were to have doubled since August, Facebook would still reach roughly 100 times as many daily active users as BeReal.

None of this is to say that BeReal and TikTok are bad choices of course; nor am I saying that you should necessarily prioritize Facebook.

I’d simply like to add a dose of realism to your 2023 planning.

As a gentle reminder, our job as marketers is to build brands and drive sales – it’s not to jump on all the latest bandwagons.

Sure, if you can see a clear way to deliver efficient and effective outcomes via the hottest new platform, by all means go for it.

But don’t expect magic from a platform simply because it’s making headlines.

Critically, if you haven’t already made that “magic” happen on Instagram or TikTok, there’s no reason to expect that you’ll fare any better on BeReal—or on the next hot platform that will surely come along behind it.

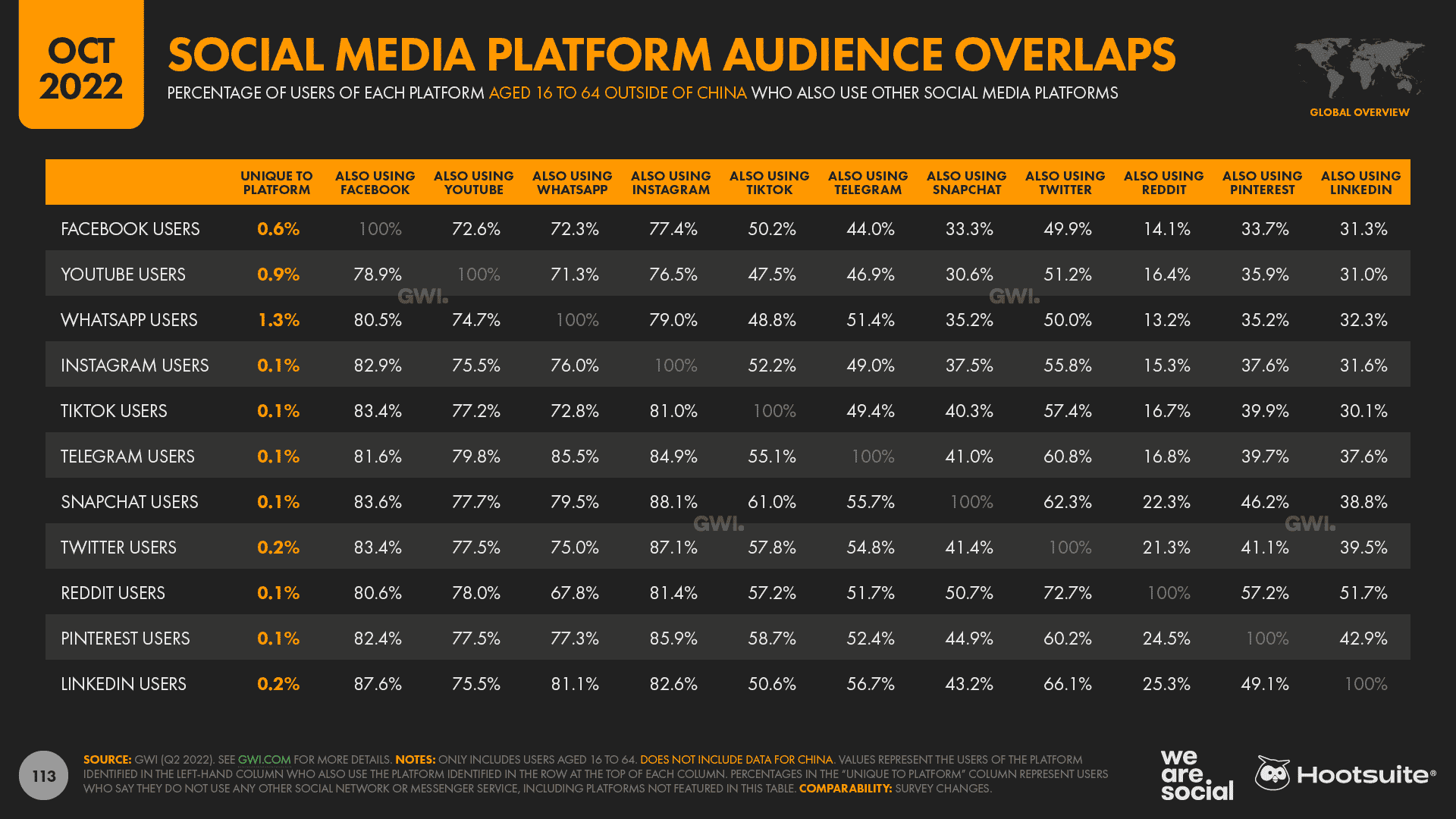

And that’s because the users of any given social platform are largely the same, even if each platform offers a slightly different demographic profile, and slightly different opportunities to engage people.

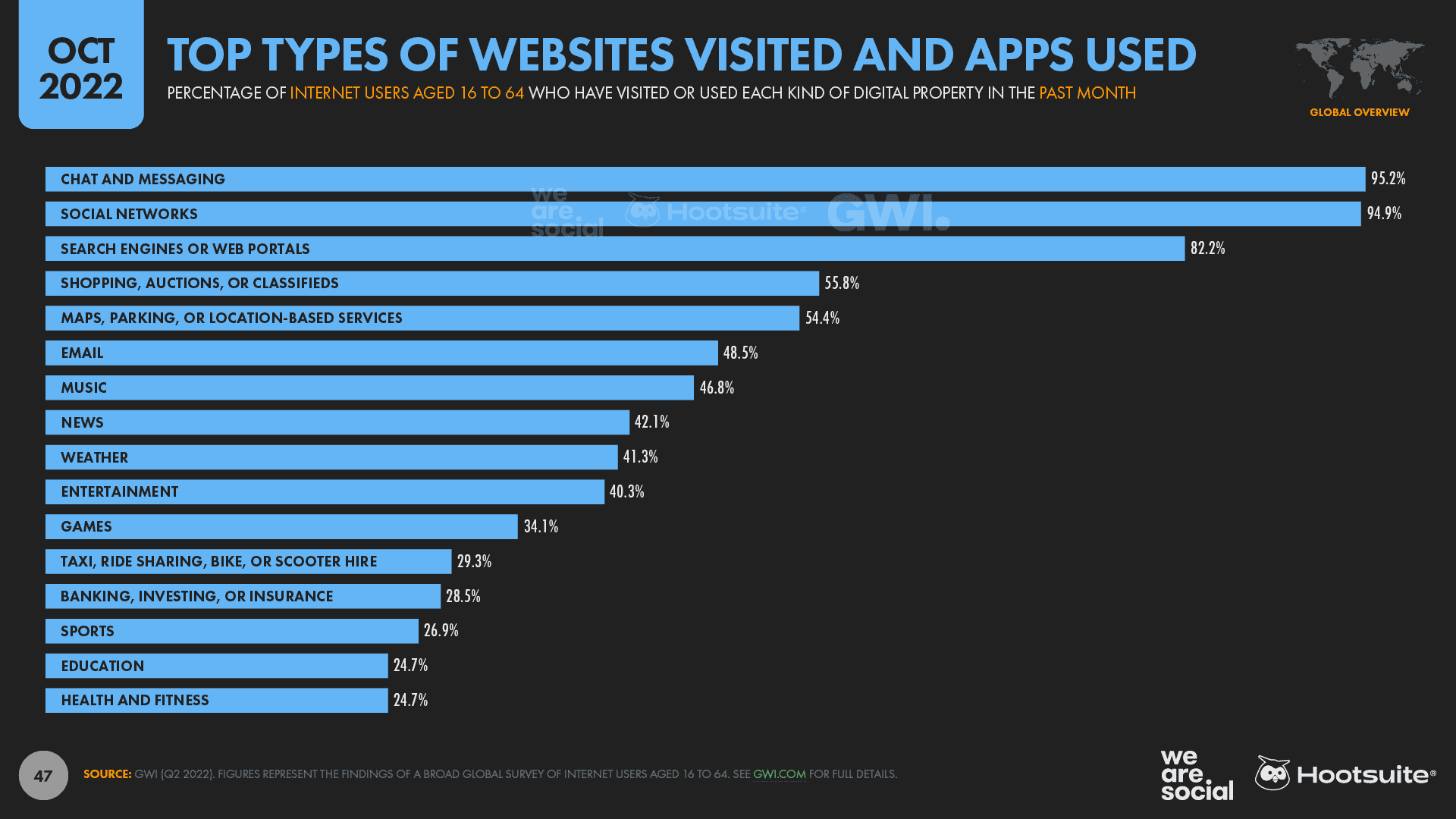

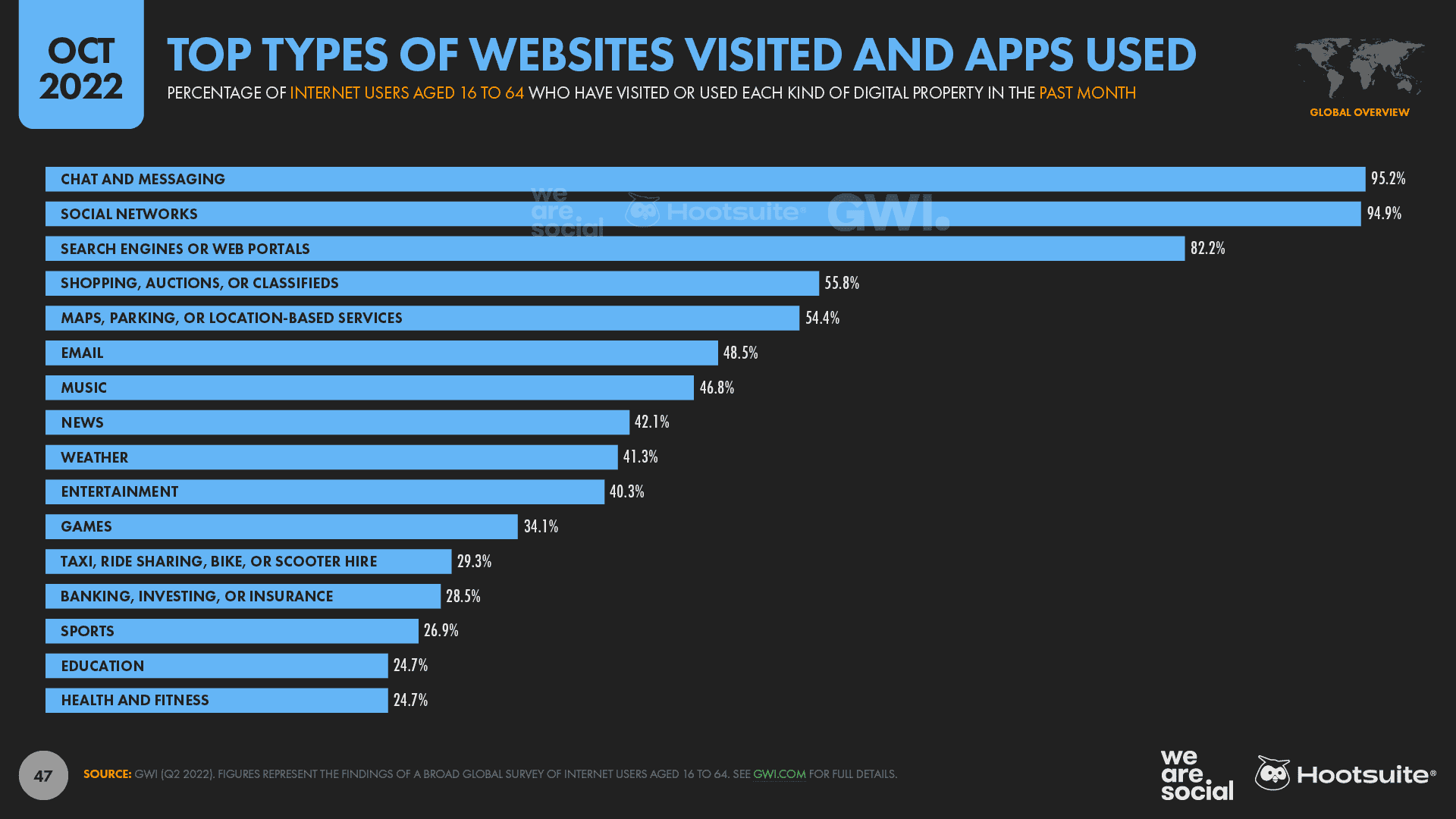

For context, 95% of working-age internet users say that they use messaging apps and social networks each month, so it’s highly unlikely that you’ll be able to reach any “unique” users on a new social platform.

Indeed, as the excellent data from GWI in the chart below shows, even the largest and most established platforms can barely claim 1% unique reach, while fewer than 1 in every thousand users on newer platforms like TikTok can be considered unique.

So, given that marketers everywhere will be under increased scrutiny over the coming months as fiscal belts tighten, my advice would be not to abandon tried and true favorites like Facebook in favor of “shiny new objects”.

The Metaverse hype hasn’t paid off (yet)

But the impact of clickbait isn’t restricted to social media.

Another headline that’s been doing the rounds in recent weeks relates to the growth of the Metaverse—or rather, a purported lack of growth.

A widely shared article published by CoinDesk reported that virtual world Decentraland has just 38 active users, despite attracting a market valuation in excess of USD $1 billion.

And no, that wasn’t a typo – the quoted active user number was indeed just 38.

However, the same article goes on to concede that this figure—which CoinDesk sourced from DappRadar—only represents the number of “unique wallet addresses” that interacted with a Decentraland smart contract.

In other words, the figure only includes those users who made an active purchase within the Decentraland environment, and it completely ignored anyone who logged in without making a purchase.

This is clearly a highly “selective” use of data though, especially because such a tight definition misses out on various popular activities like virtual concerts and fashion shows.

For example, Nielsen (via Statista) reports that more than 12 million users attended Travis Scott’s Astronomical event in Fortnite in 2020.

So, perhaps unsurprisingly, Decentraland reacted quite strongly to CoinDesk’s claims, describing the user metrics cited in the article as “inaccurate”.

However, in the response it published to its own blog, Decantraland also revealed that it currently has fewer than 57,000 monthly active users.

That’s certainly many more than 38, but – with a reported valuation of more than a billion dollars—that would value each MAU at more than $17,500 each.

Of course, investors will likely expect the active user figure to increase over time, but the same blog post also reveals that Decantraland’s monthly active users have actually declined since “the early metaverse hype of late 2021”.

So, are the naysayers right – is “the Metaverse” really just a lot of hot air?

Well, other data suggests not.

Sure, the user figures for Decentraland and the Sandbox don’t offer much to get excited about (yet), but similar figures for other “virtual worlds” look a lot more promising.

Part of this comes down to definitions of course, and each person’s perspective may vary depending on how they think of the “Metaverse”.

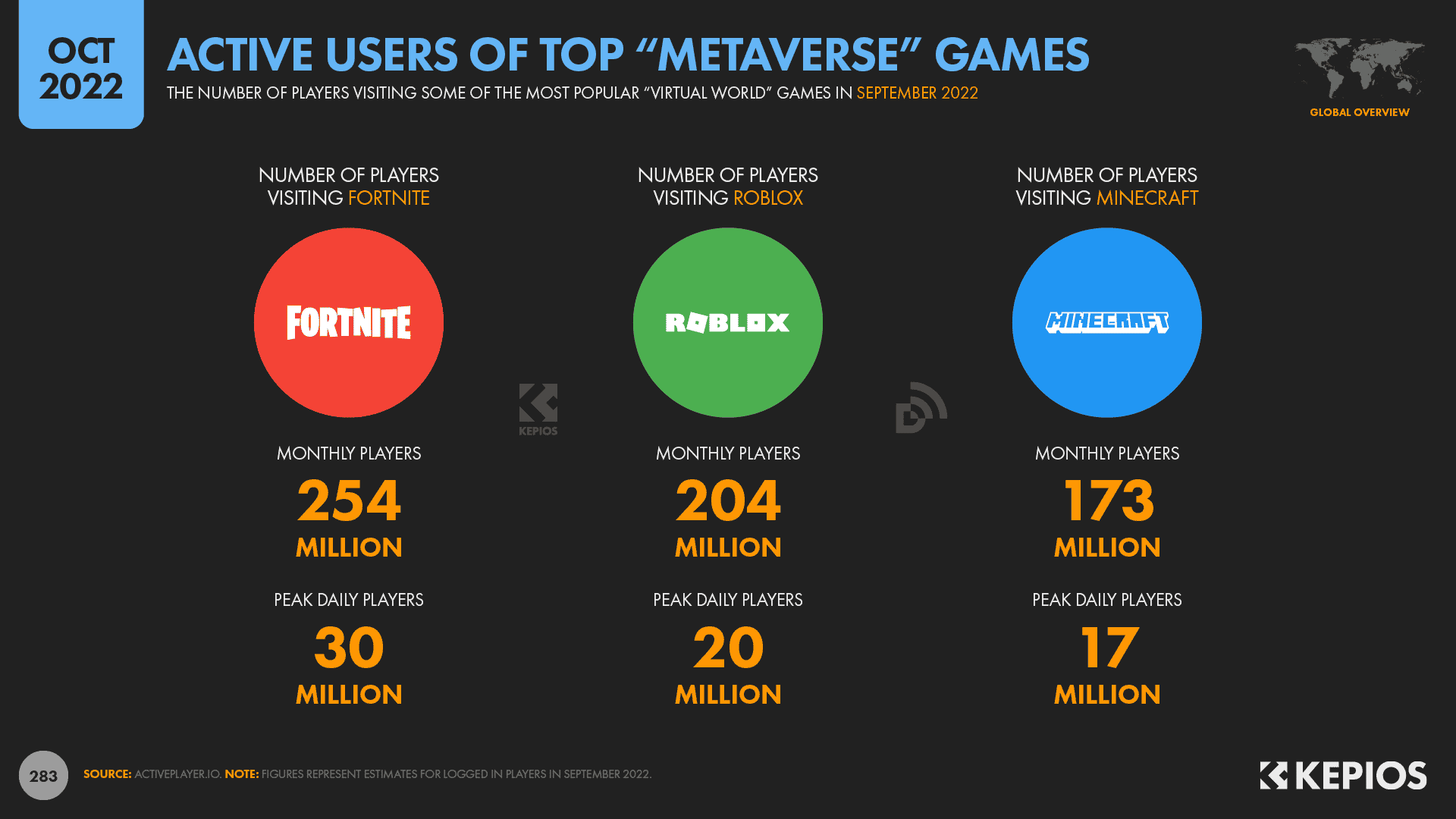

For example, if you’re willing to include immersive games that feature in-world experiences in your Metaverse definition, there are already plenty of impressive numbers to explore.

For starters, analysis from ActivePlayer.io suggests that Fortnite, Roblox, and Minecraft—all of which might qualify as Metaverse-like “virtual worlds”—already attract hundreds of millions of monthly active users (MAUs):

- Fortnite: 254 million MAUs in September 2022, with a peak of 30 million per day

- Roblox: 204 million MAUs in September 2022, with a peak of 20 million per day

- Minecraft: 173 million MAUs in September 2022, with a peak of 17 million per day

So, despite sensational headlines offering highly selective readings of the data—albeit in both directions—there’s also plenty of tangible evidence to suggest that the Metaverse does indeed have potential.

However, whether that potential extends beyond the current gaming focus, and exactly how much that potential is worth, remains to be seen.

As a result, Metaverse marketing opportunities still appear to be limited to brands who sell items like NFTs within virtual worlds, or to brands who can turn their virtual-world exploits into real-world PR.

So, while we’ll certainly keep tracking the popularity of virtual worlds, if you can’t already see an obvious way to tap into these environments, I’d suggest that your marketing dollars are probably better spent elsewhere – at least for the time being.

So, let’s return our attention to the “real” world…

YouTube tops time spent

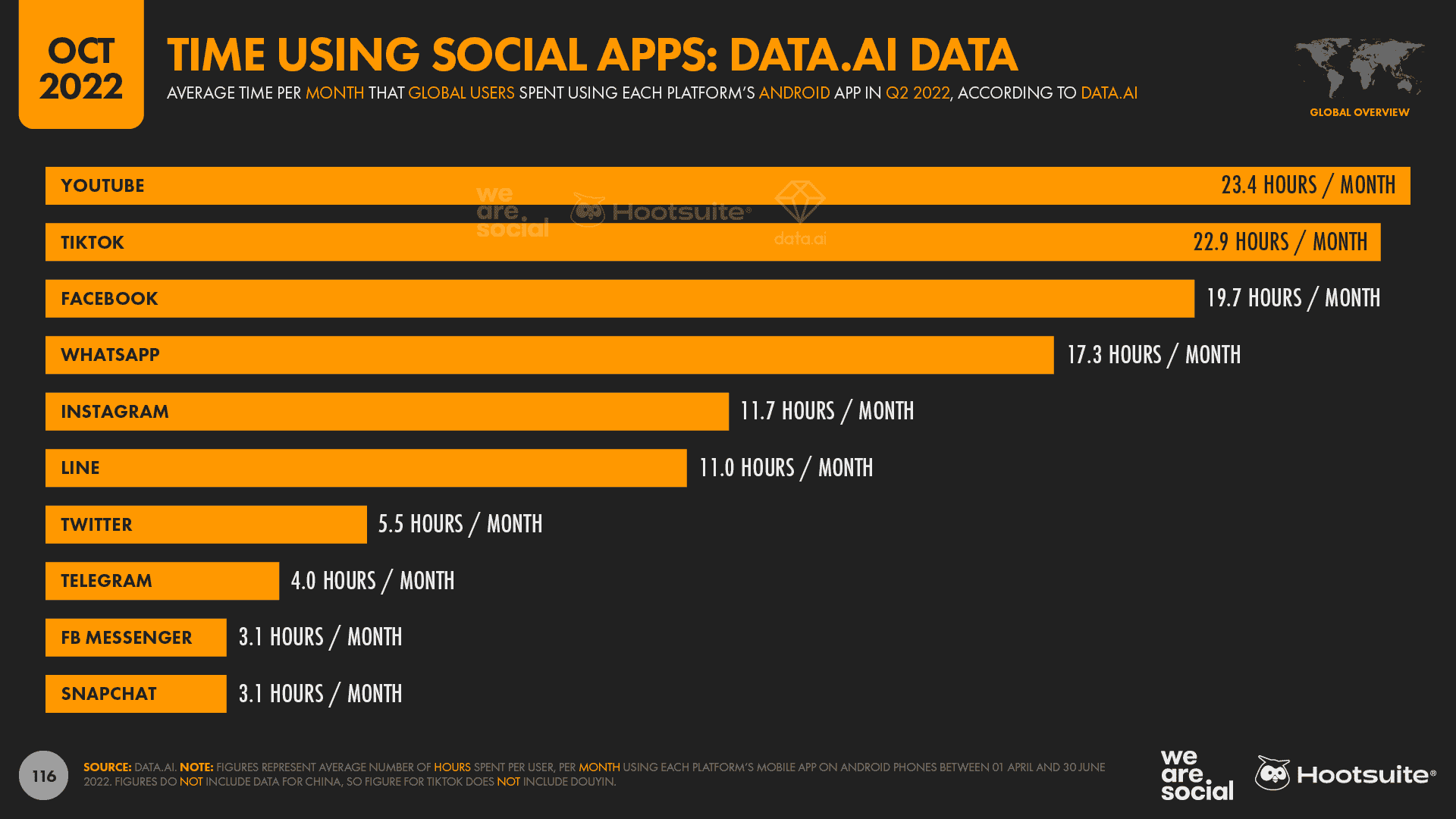

As you may have noticed in one of the charts we featured above, YouTube has reclaimed top spot in data.ai’s latest ranking of social media apps by average time spent.

The typical user spent an average of 23.4 hours each month using YouTube’s app between 01 April and 30 June 2022, equating to almost one-and-a-half days of total waking time.

TikTok slipped back to second place in the Q2 ranking, with users outside of mainland China spending an average of 22.9 hours per month using the short-video platform in the second quarter of 2022.

As we noted above though, data.ai’s numbers have better news for Facebook, which saw its average monthly time per user increase to 19.7 hours per month in Q2, compared with 19.4 hours per month in the first three months of 2022.

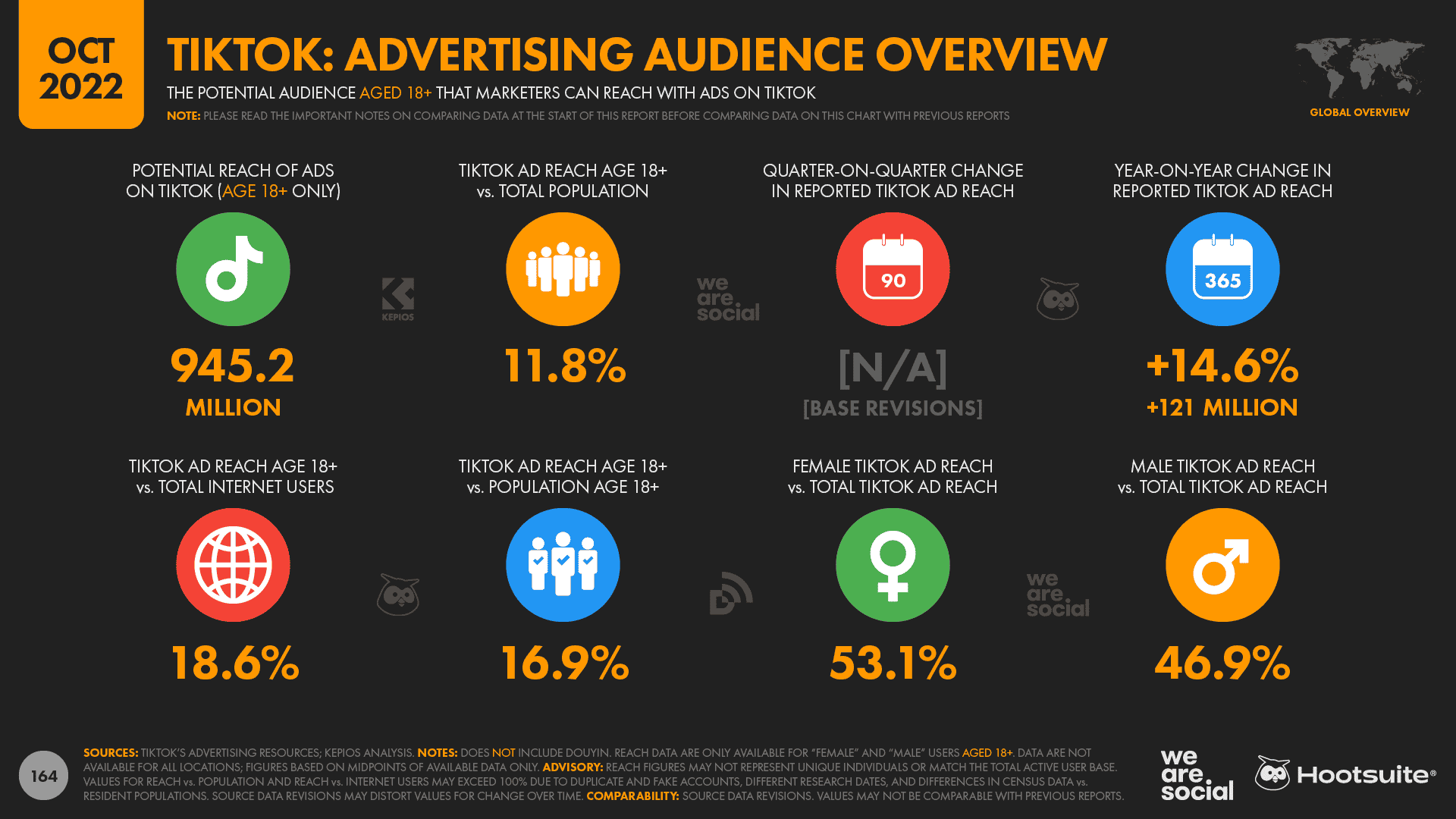

TikTok keeps climbing

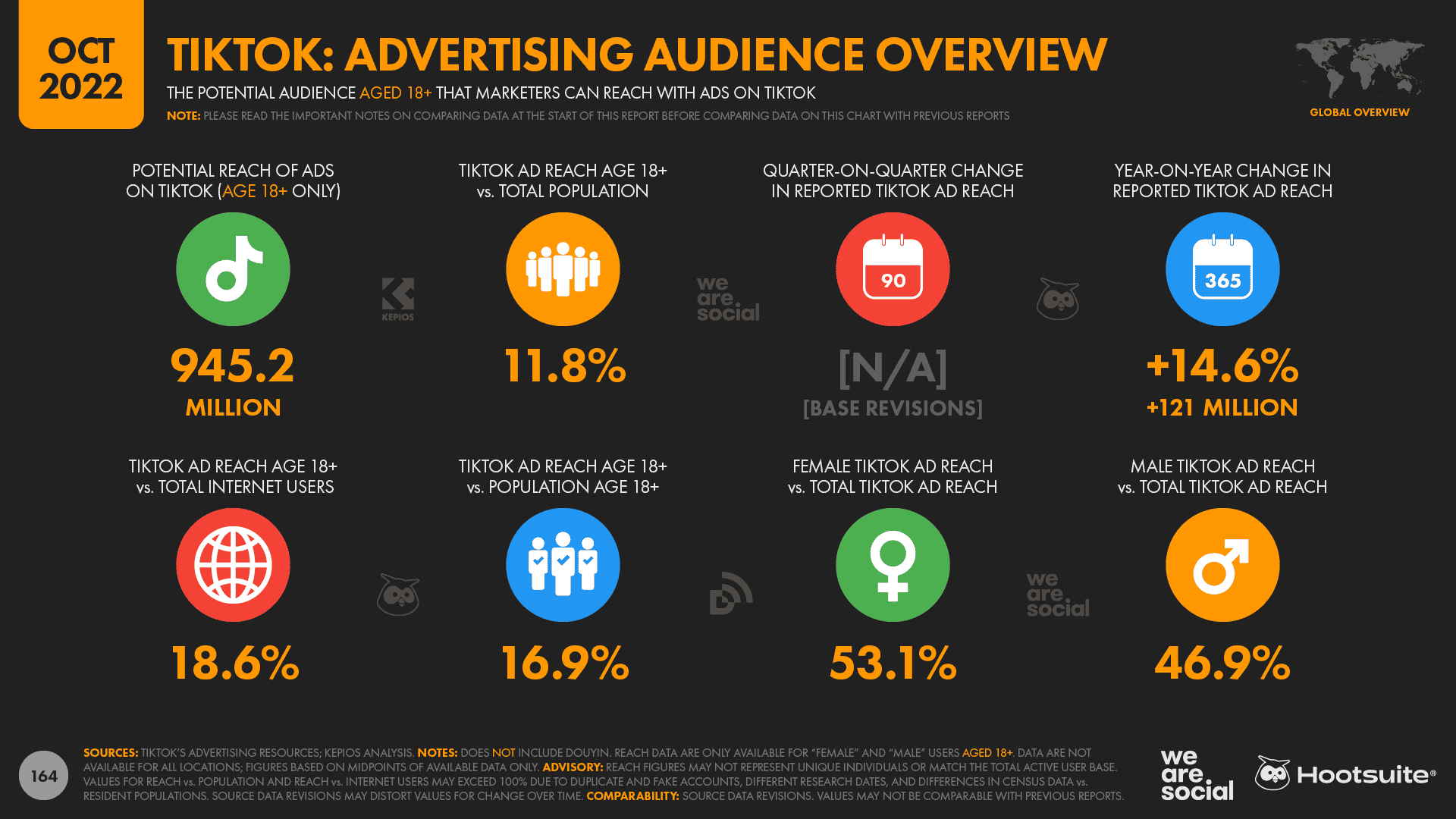

Due to quirks in the way that Bytedance’s tools report potential advertising reach for its various services, we’ve revised our ad reach numbers for TikTok in our October 2022 report.

However, it’s important to stress that these numbers don’t represent a decline in TikTok use compared with previous quarters.

Rather, the difference in our reported numbers results from a change in the source data that we use to calculate the numbers that we report.

Based on these revisions, our latest analysis indicates that TikTok ads now reach 945 million adults over the age of 18 each month, which is 121 million more than they reached just 12 months ago.

TikTok’s ad reach has grown by 14.6% over the past year, and the platform’s ads now reach more than 1 in 6 adults on Earth every month.

TikTok’s revenues continue to grow

And it’s not just TikTok’s ad reach that’s growing, either; users continue to spend more and more money on the platform too.

Analysis from Sensor Tower reveals that TikTok’s worldwide revenues – which include spend on Douyin in China – reached more than USD $914 million between July and September 2022, taking its cumulative, lifetime total to roughly USD $6.3 billion (Note that we separate user figures for TikTok and Douyin elsewhere in our reports.)

And what’s more, this revenue figure only includes consumer spend on TikTok – which comes largely via the purchase of TikTok Coins – and doesn’t include the revenues that Bytedance earns from advertising.

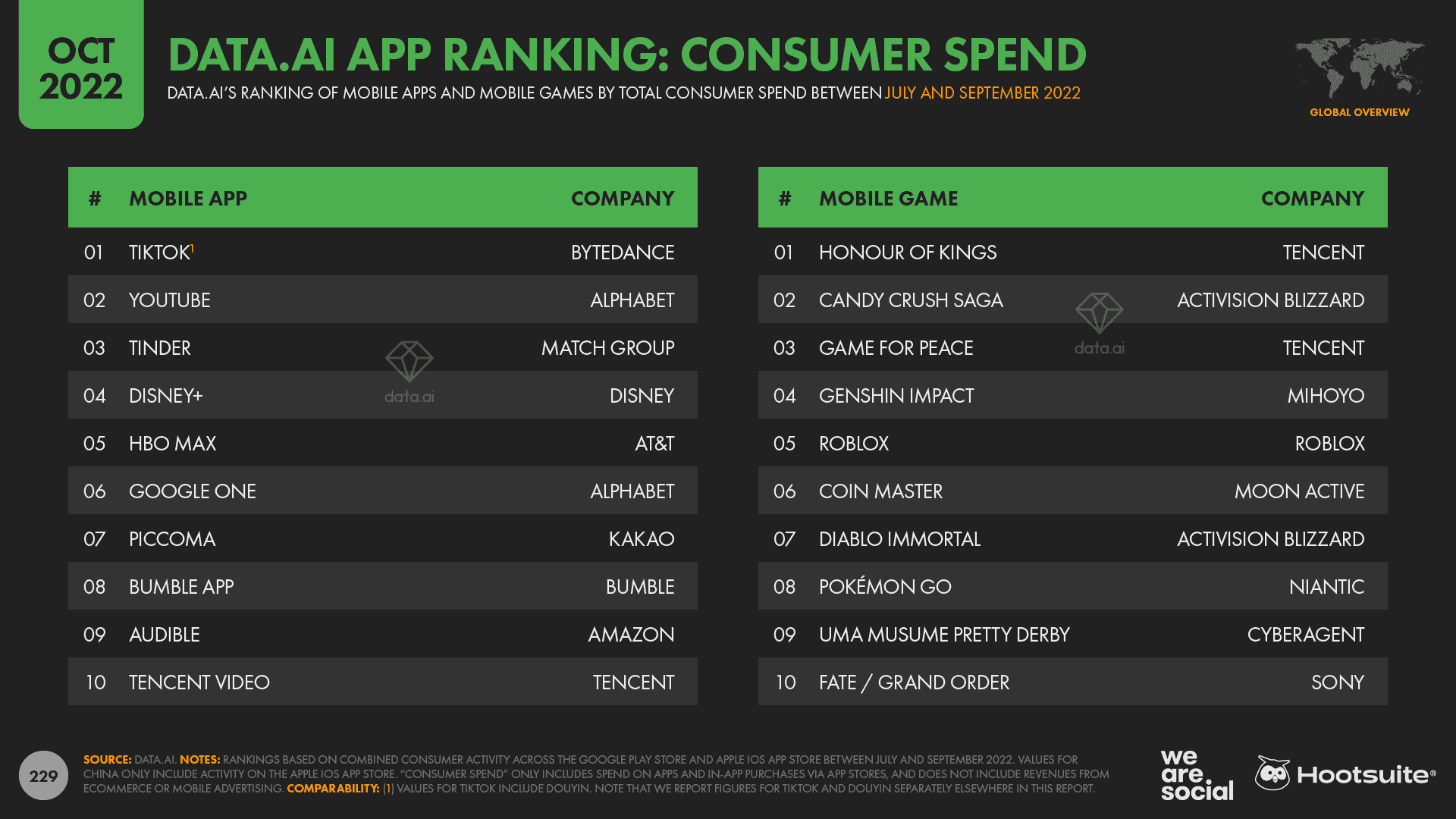

Both data.ai and Sensor Tower report that TikTok was the world’s top grossing non-game mobile app in Q3 2022, as ranked by combined consumer spend across the Google Play and Apple iOS stores.

Reels keep rolling

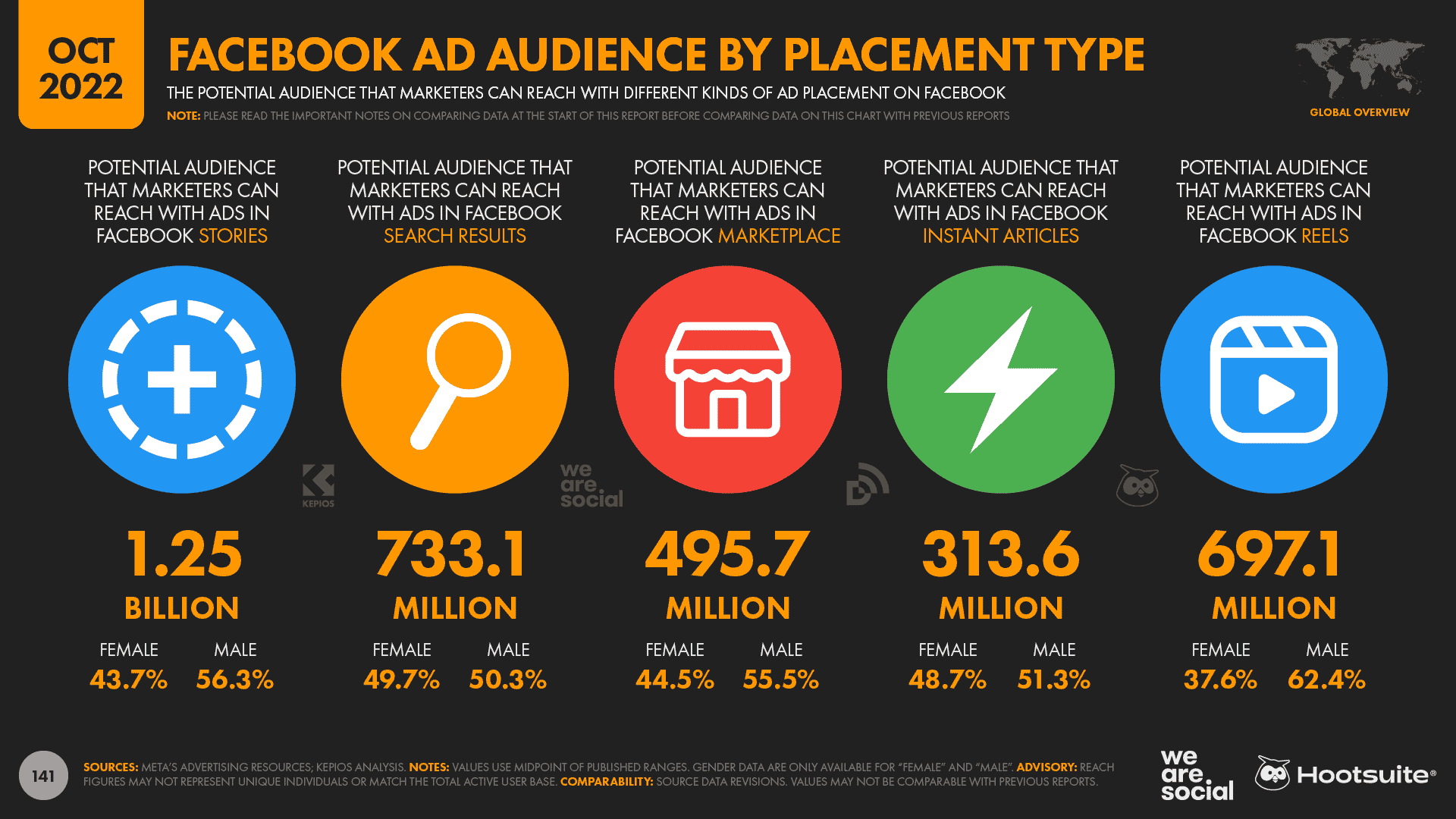

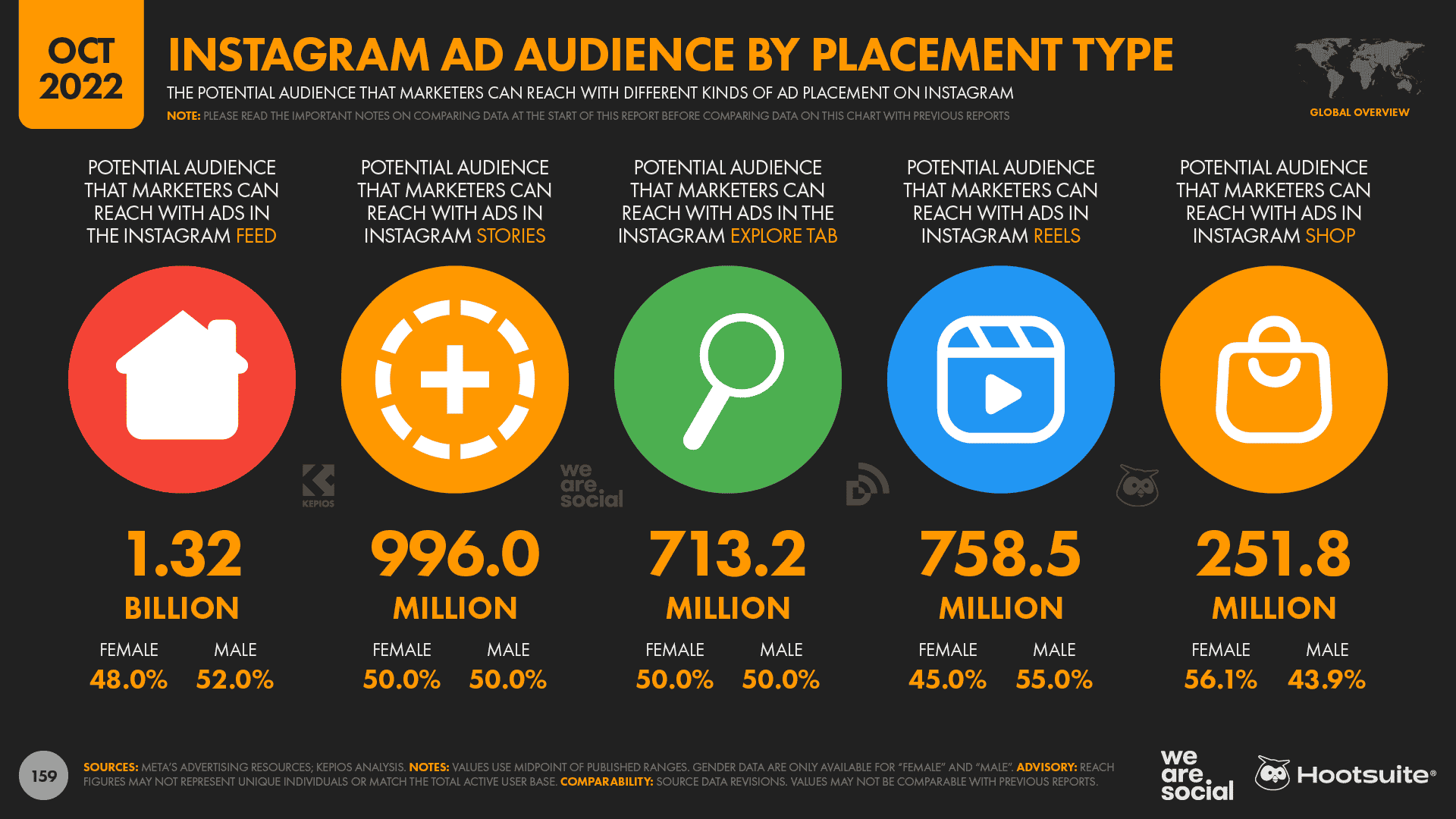

The number of users that marketers can reach with ads in Meta’s Reels feeds continues to grow.

Figures published in the company’s ad planning tools reveal that the global audience for ads in Facebook Reels has jumped by almost 50% over the past three months.

The latest potential reach figure is just a shade below 700 million users, reflecting an increase of more than 220 million users since July 2022.

The number of users seeing ads in Instagram’s Reels feed has also increased since last quarter, albeit at a much more modest rate.

Figures for October 2022 show that Instagram Reels ads now reach 758.5 million users, which is 0.5% more than the 754.8 million users that Meta’s ad planning tools reported back in July.

Social’s popular on the web still too (not just apps)

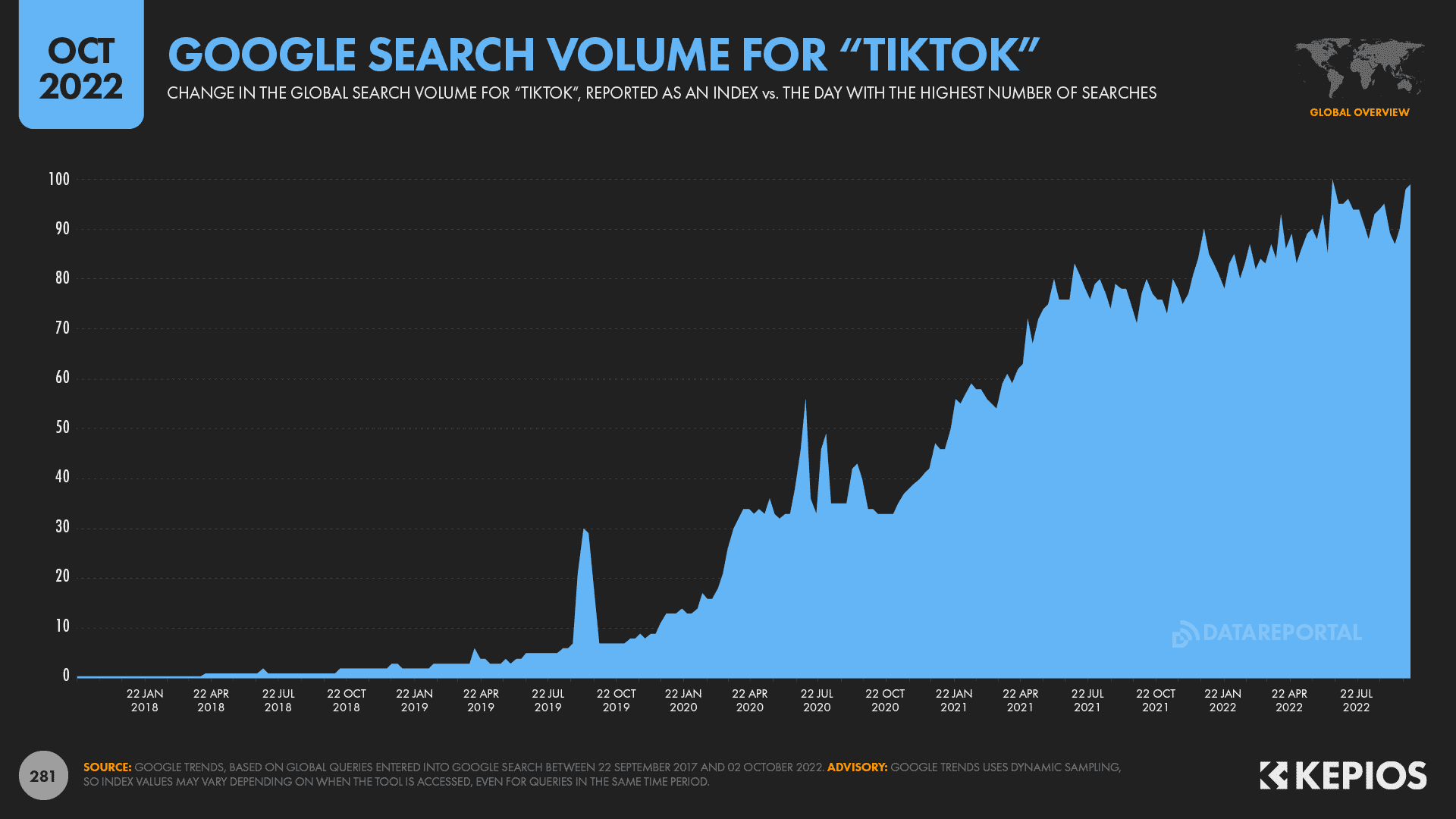

While it’s no secret that TikTok has been adding millions of users over recent months, the platform has seen impressive growth in another metric that may come as more of a surprise.

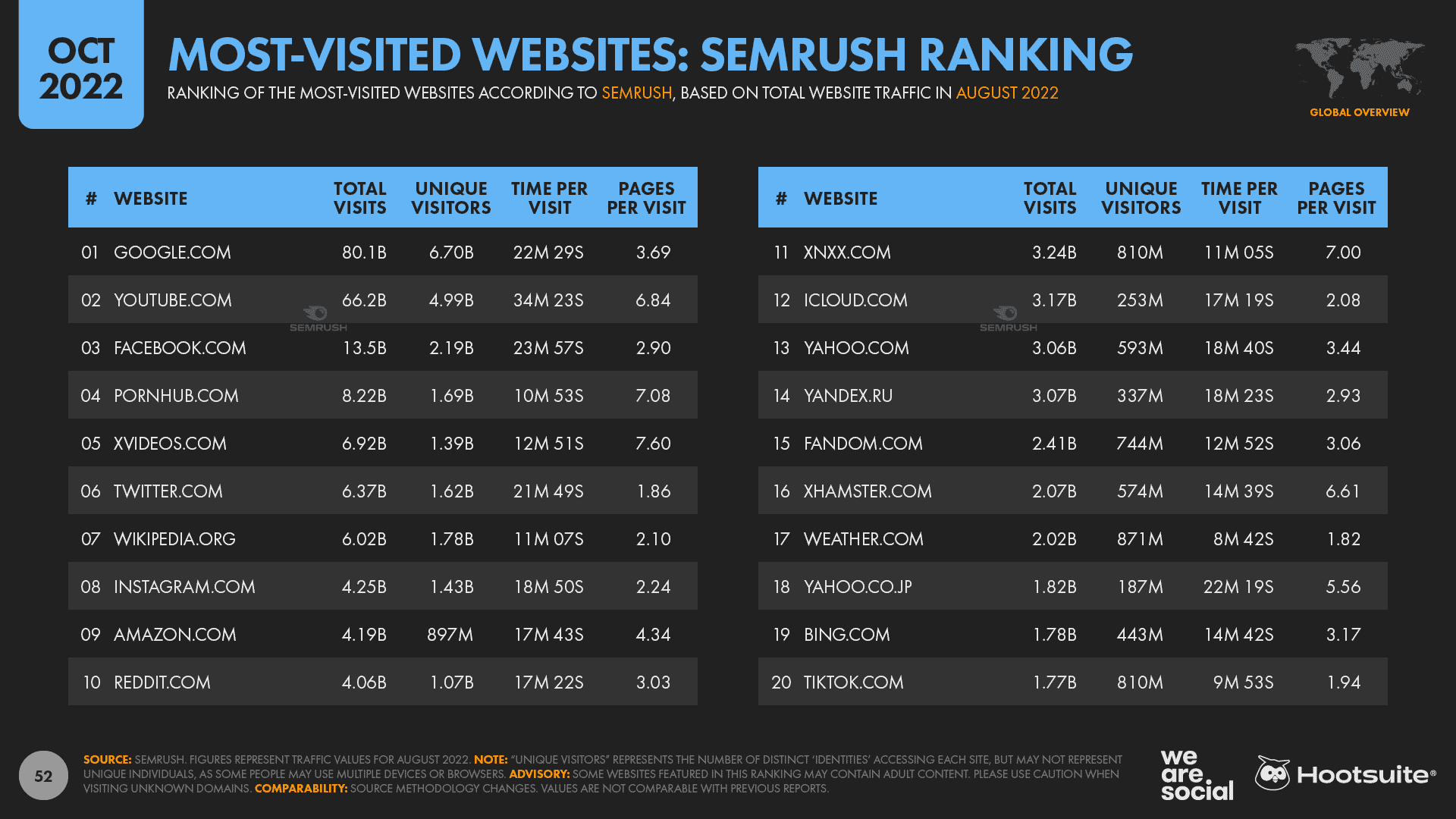

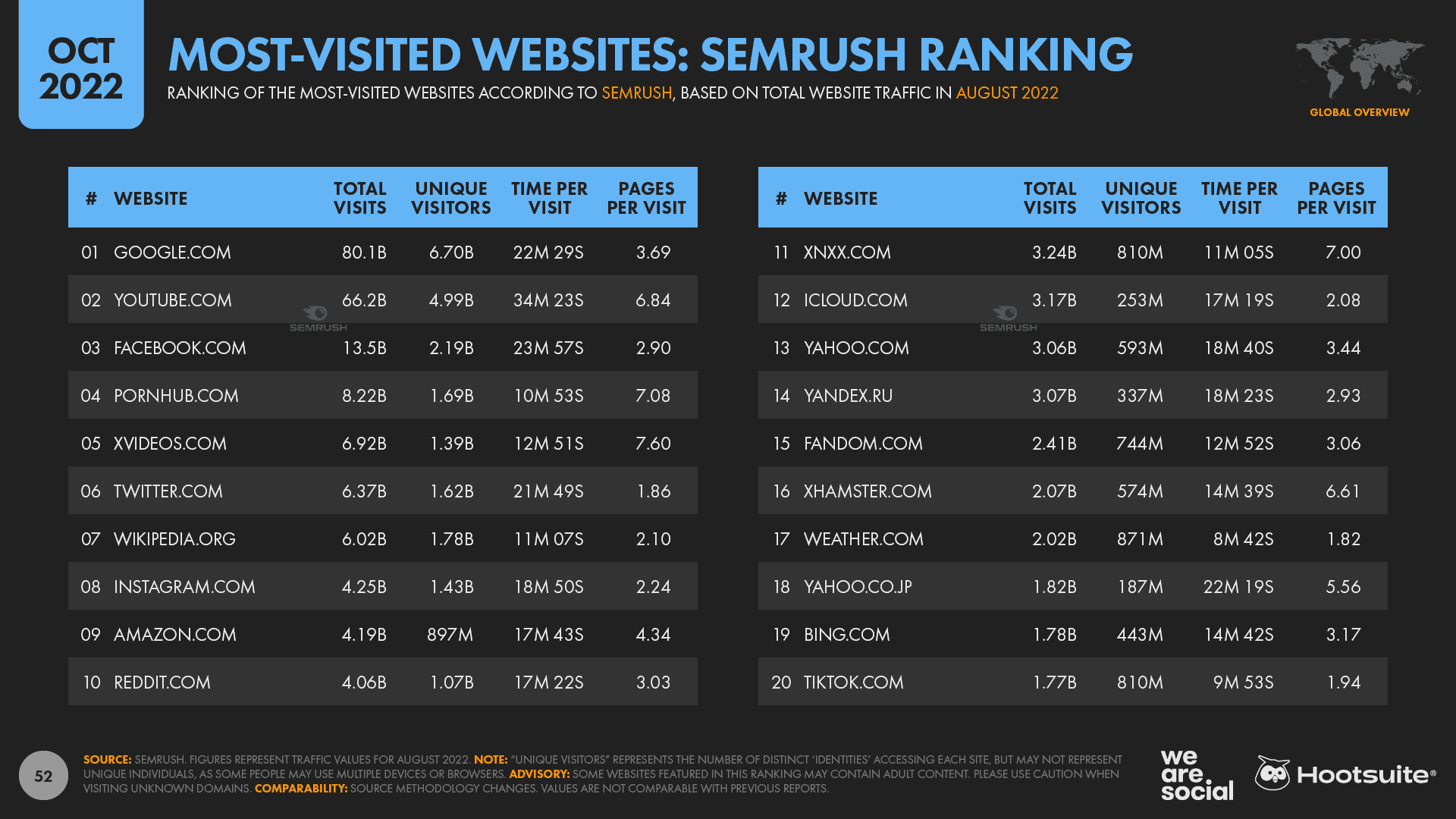

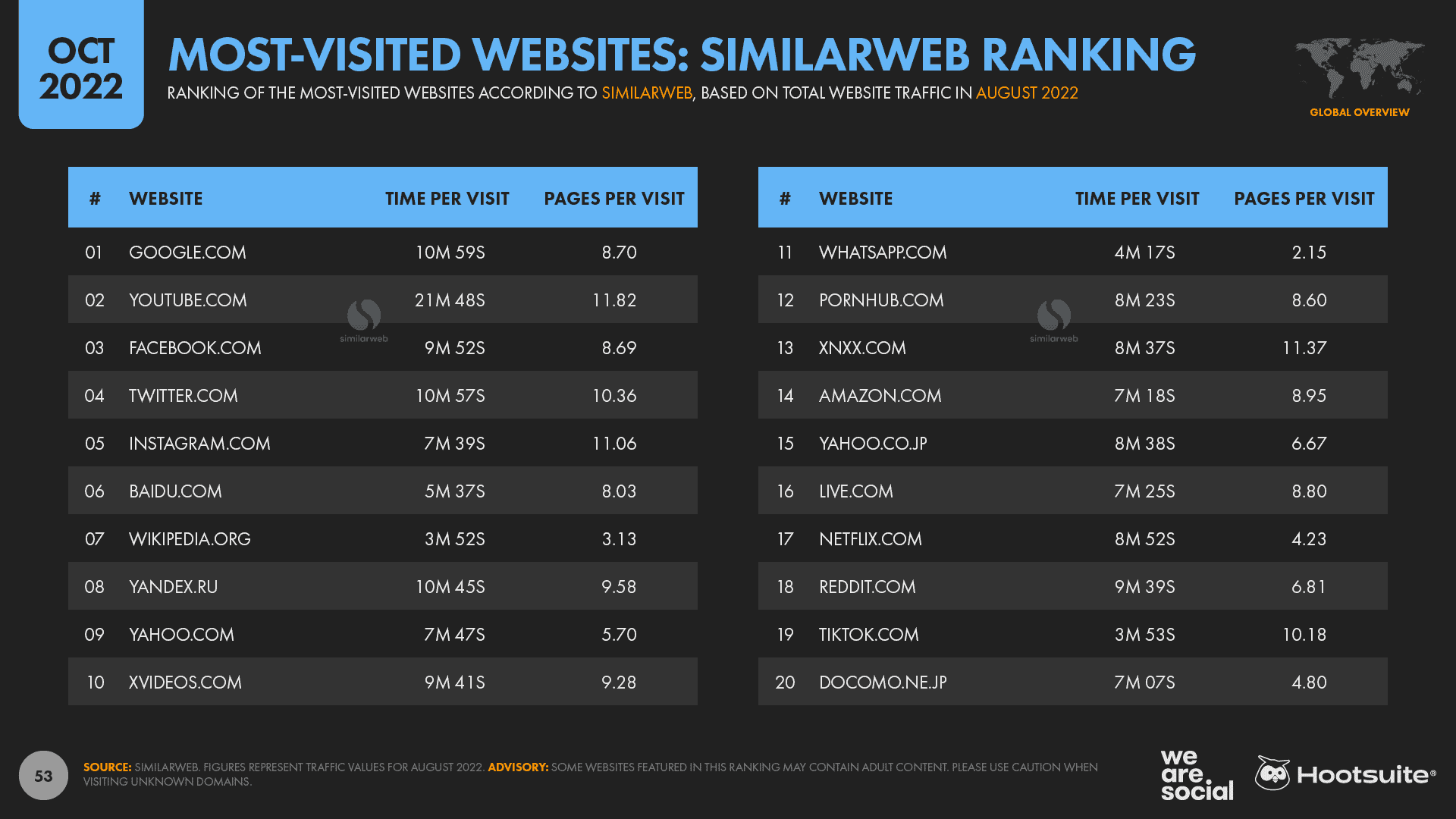

Both Semrush and Similarweb report that TikTok.com has now entered the top 20 most-visited websites in the world.

In other words, TikTok isn’t just one of the world’s biggest mobile apps; it’s also one of the hottest properties on the web.

To put this in perspective, Semrush reports that TikTok.com now attracts more than 800 million unique visitors per month, which may equate to more than half of the platform’s total active user base.

Meanwhile, data from Google Trends also reveals that searches for “TikTok” have increased steadily over recent months.

Across all queries entered into Google around the world between 01 July and 20 September 2022, TikTok ranked 25th by total search volume.

And given similar trends for Facebook, Instagram, and WhatsApp Web, there’s a good chance that many of these searches were conducted by people hoping to consume TikTok content from within a web browser, as opposed to people simply looking to learn what TikTok is, or to download the app.

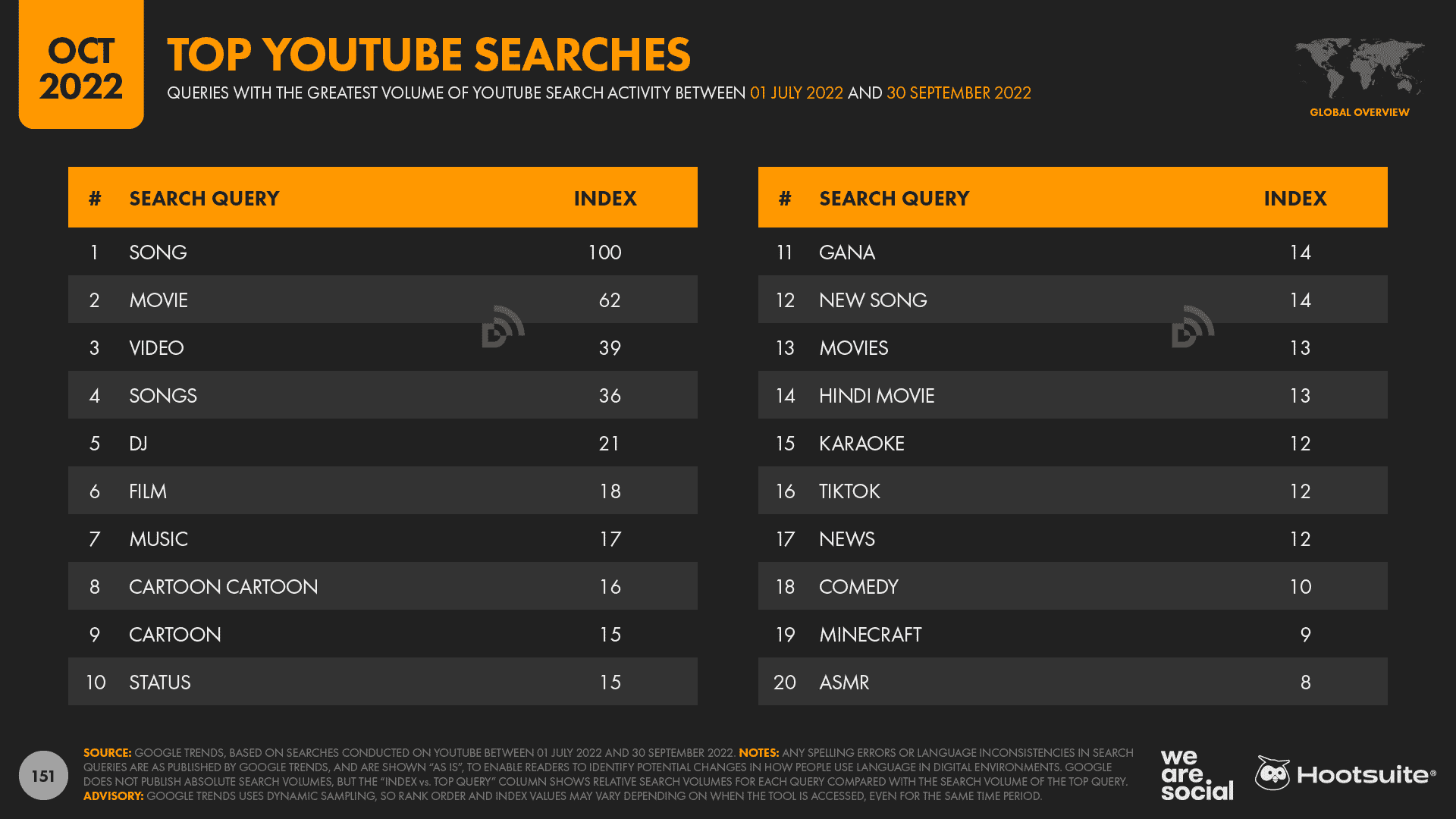

As an aside, it’s also interesting to note that “TikTok” currently ranks 16th in the world’s top queries on YouTube.

There’s a certain irony to these search trends though, considering that Google execs are increasingly worried about the number of people who’ve moved their search activity from search engines to social platforms.

There’s little data to tell us whether TikTok’s web users are any different to the users of its mobile app, but—even if users were to be the same – the usage context in a web browser will likely be quite different to the one in the platform’s app.

Having said that, the TikTok experience is no less compelling in a web browser, with visitors landing directly in a “for you” feed without needing to create an account or log in (try it for yourself here).

It’s unclear whether this rise of TikTok activity in web browsers has any distinct implications for marketers, but nonetheless, it’s worth considering if you’re planning TikTok content.

But it’s important to note that this “social web” phenomenon isn’t unique to TikTok.

Semrush’s latest data reveals that the websites of most of the top social platforms continue to attract billions of unique visitors each month, although it’s worth noting that – due to people’s use of multiple connected devices—these figures may include a meaningful degree of duplication when it comes to unique individuals.

YouTube sees the highest number of unique visitors to its website, with Semrush reporting that a whopping 5 billion unique devices visited YouTube.com in August 2022.

Meanwhile, despite the company’s own data suggesting that app usage dominates Facebook access, more than 2 billion unique devices also visited Facebook.com in August.

The websites of Twitter and Instagram continue to attract well over a billion unique visitors each month too.

And the number for Twitter is particularly interesting, because it suggests that a significant number of people continue to use the platform without logging in – and perhaps without even creating an account.

Similarly, despite the platform reporting unique daily users of just 50 million, Reddit’s website also attracts more than 1 billion unique visitors each month, suggesting that many of the platform’s visitors don’t register or log in.

And while it sits just outside of Semrush’s current top 20, Similarweb reports that WhatsApp.com is also a favorite on the web, attracting more unique visitors than many of the world’s top adult sites.

Podcasts capture more of people’s time

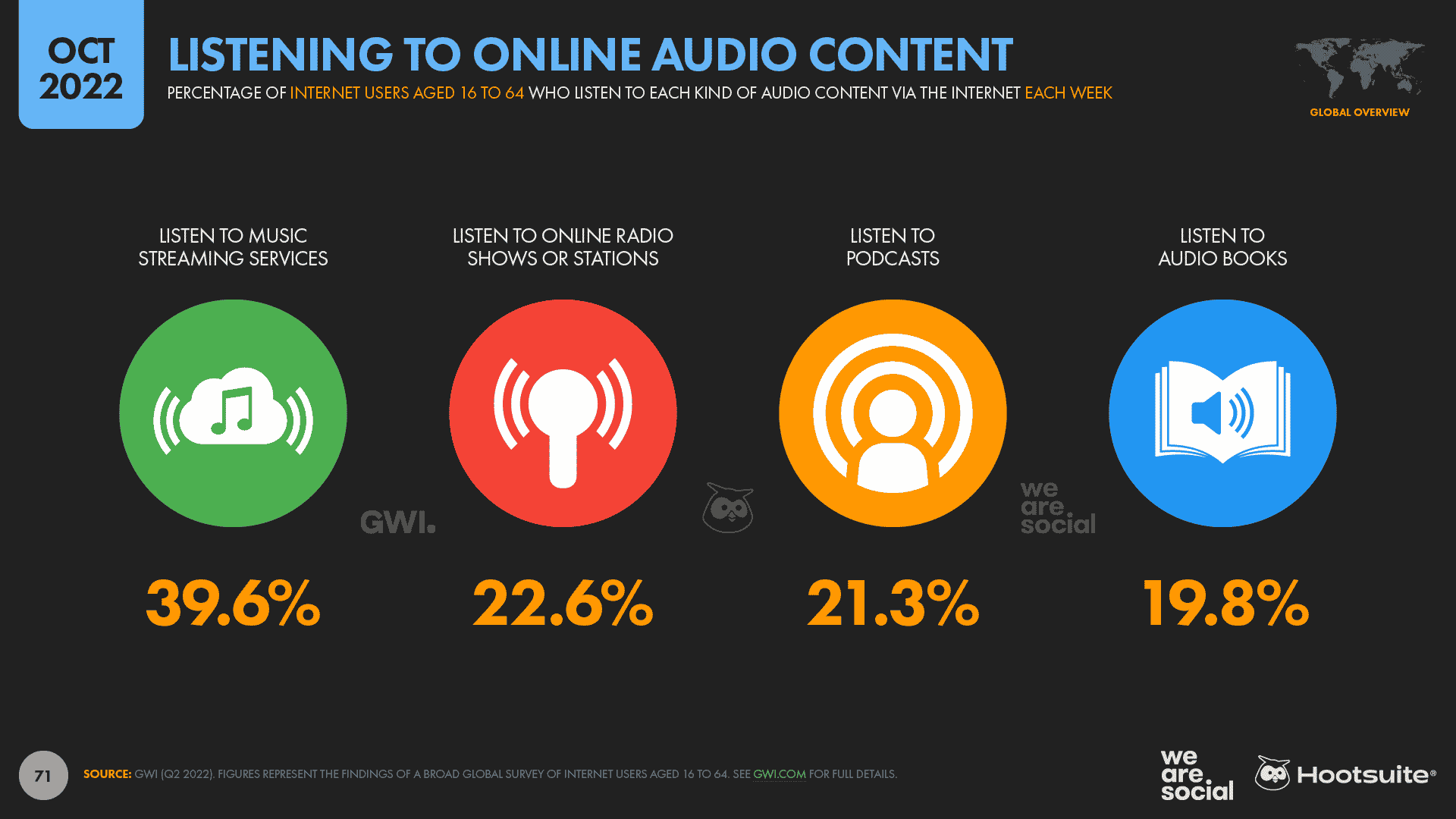

The latest data from GWI reveals that the typical working-age internet user now spends more than an hour per day listening to podcasts.

At a worldwide level, the average daily time spent listening to podcasts has increased by 7% over the past year, equating to an additional 4 minutes per day.

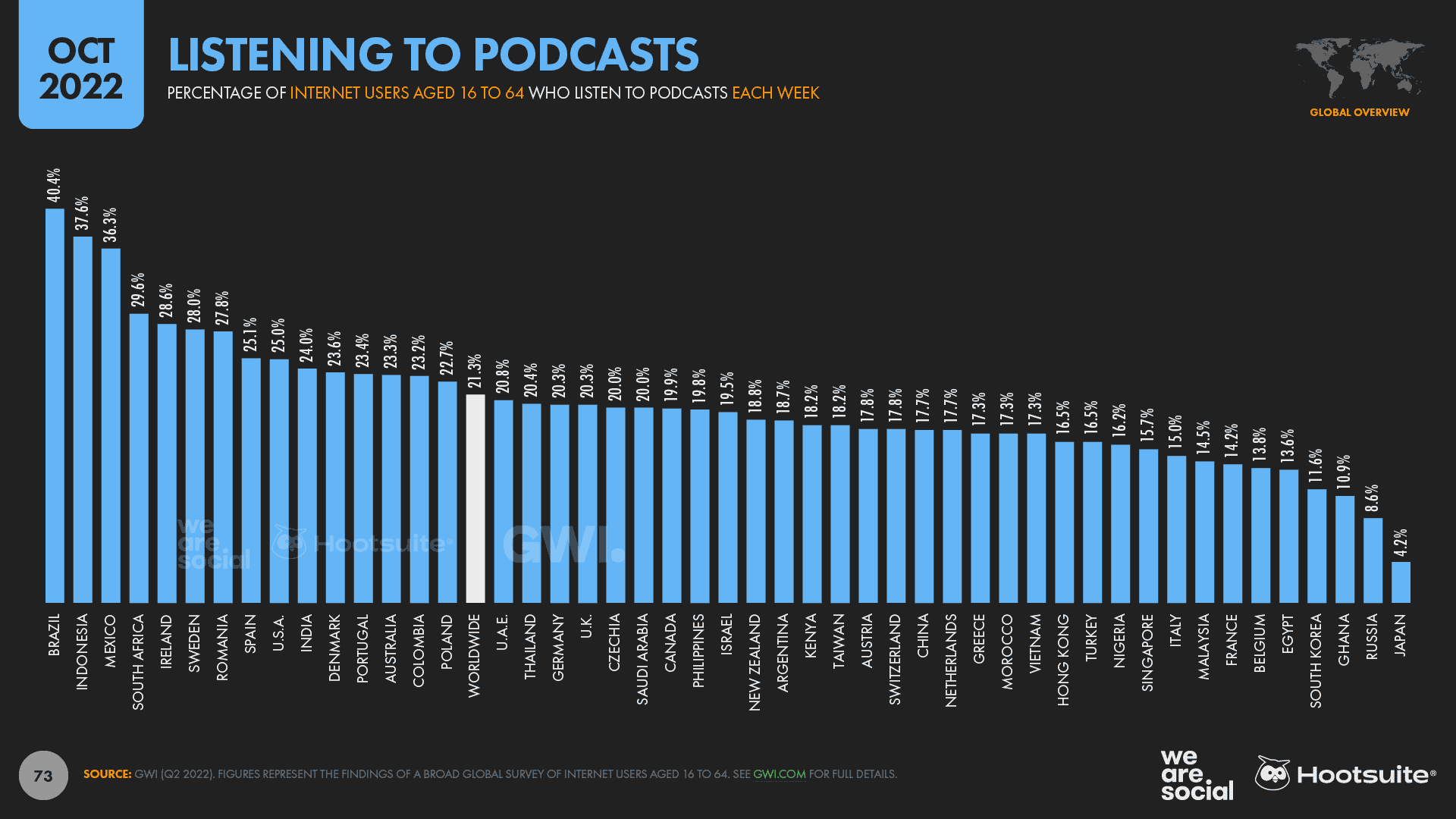

21.3% of internet users aged 16 to 64 now listen to podcasts each week, for an average of 61 minutes per day.

For perspective, these figures suggest that working-age adults in the 48 countries covered by GWI’s survey will spend a combined total of more than 24 million years listening to podcasts in 2023.

It’s interesting to note that the popularity of podcasts varies significantly by culture, although there’s no obvious pattern connecting countries where podcasts are either more or less popular.

Brazilians are the biggest consumers of podcast content, with more than 4 in 10 working-age internet users in the country saying that they listen to at least one podcast each week.

At the other end of the spectrum, Japanese people are the least likely to consume podcasts, with fewer than 1 in 20 working-age internet users in the country saying that they’ve listened to a podcast in the past seven days.

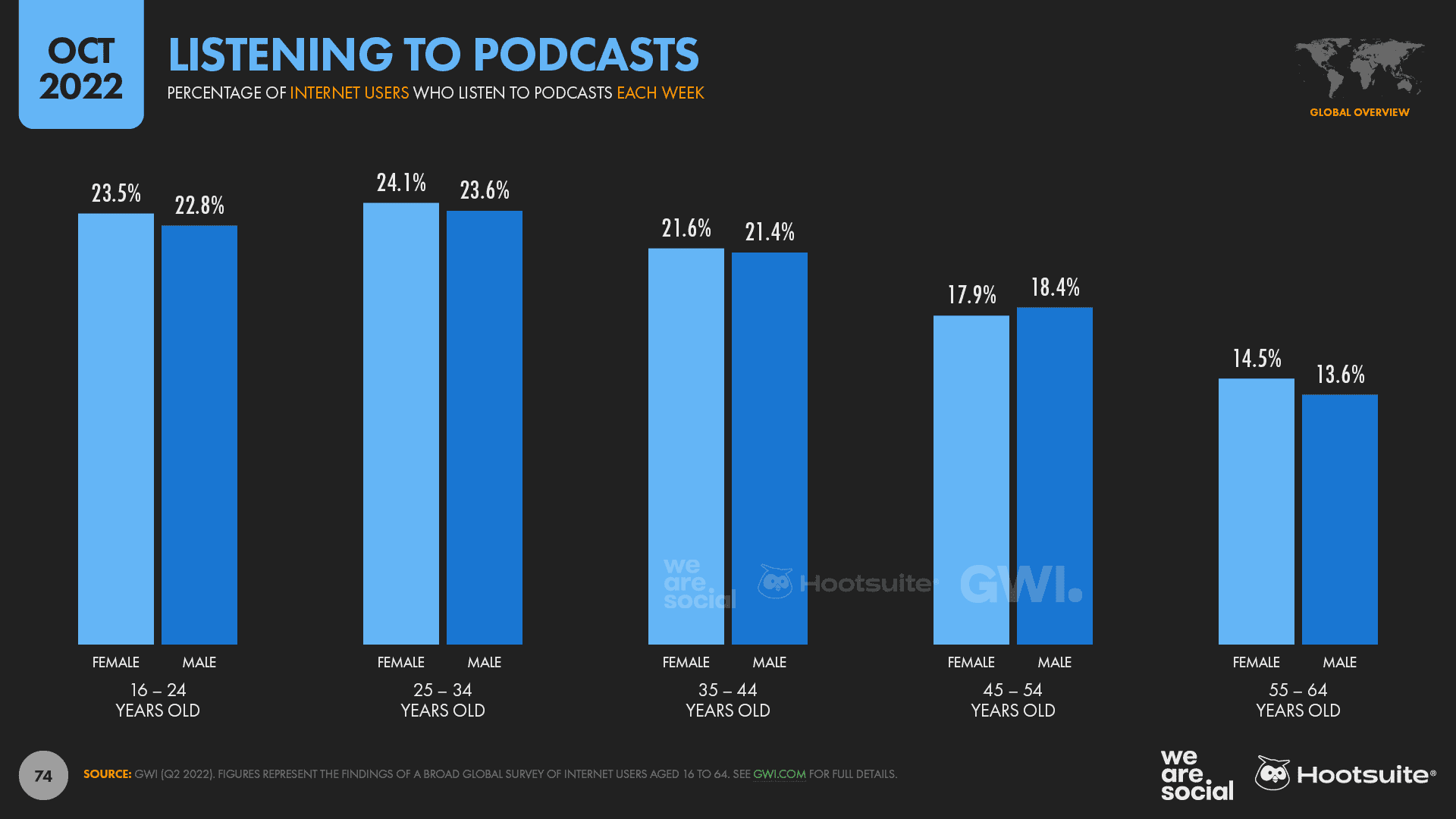

Younger age groups are more likely to listen to podcasts than their parents’ generation, although Millennials are ahead of Gen Z when it comes to the share of internet users who tune in to podcasts each week.

It’s also interesting to note that women are more likely to say that they listen to podcasts compared with men, which may go against the stereotype of the “typical” podcast listener.

Online shopping beats out email, music, and more

Shopping apps place fourth in GWI’s latest ranking of the types of websites and mobile apps that people use each month.

Almost 56% of the world’s working-age internet users say that they’ve used an online shopping, auction, or classified platform in the past 30 days, putting shopping ahead of email, music, and even news and weather services.

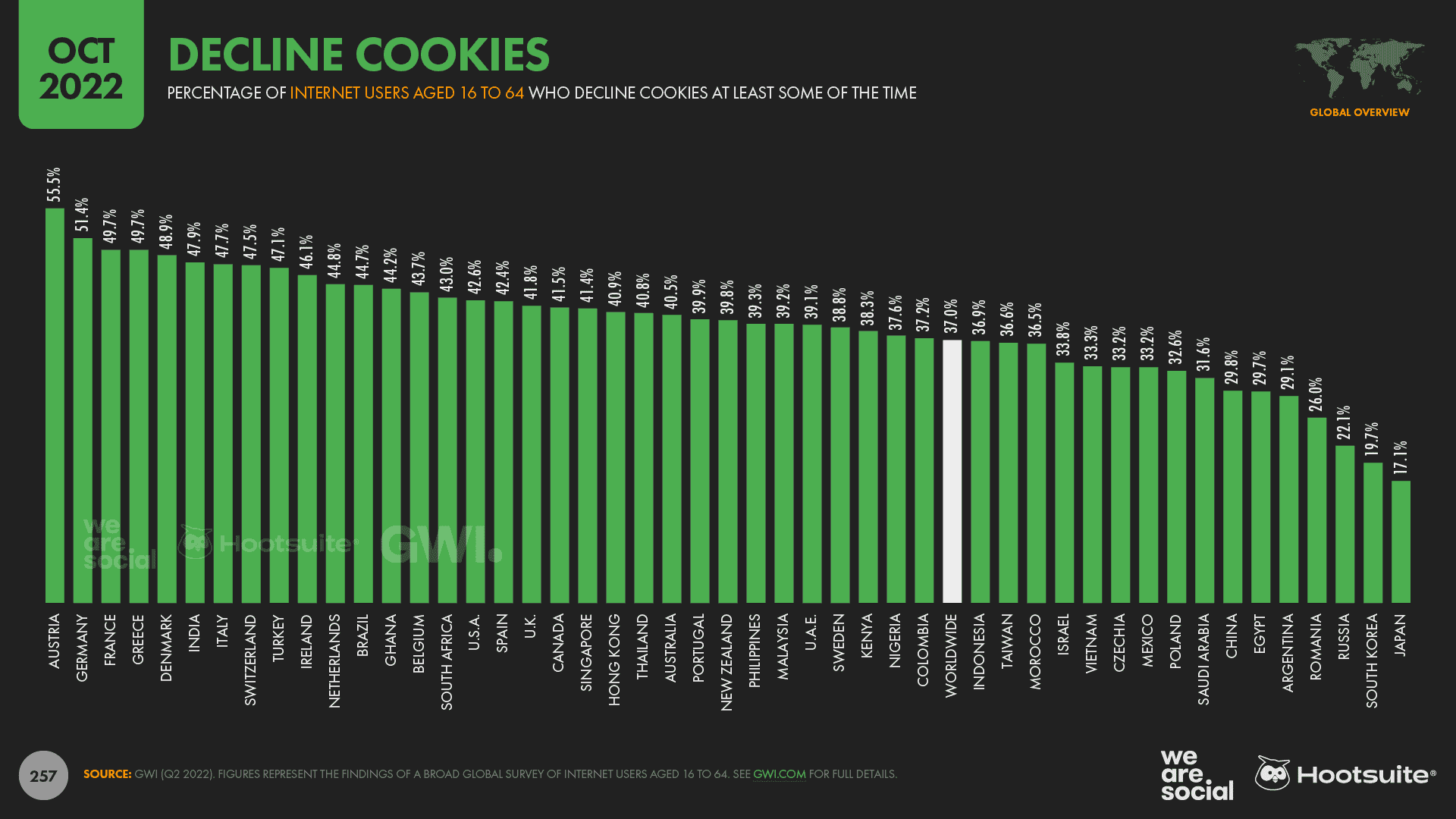

If you’ve spent any time reading about online privacy, you might be surprised to learn that the majority of internet users still accept cookies.

At a global level, GWI finds that barely 37% of working-age internet users decline cookies at least some of the time.

Austrians and Germans are the most likely to decline cookies, with more than half of internet users between the ages of 16 and 64 saying that they take active steps to reject the internet trackers.

At the other end of the spectrum, fewer than 1 in 5 people in Japan and South Korea say that they decline cookies at least some of the time.

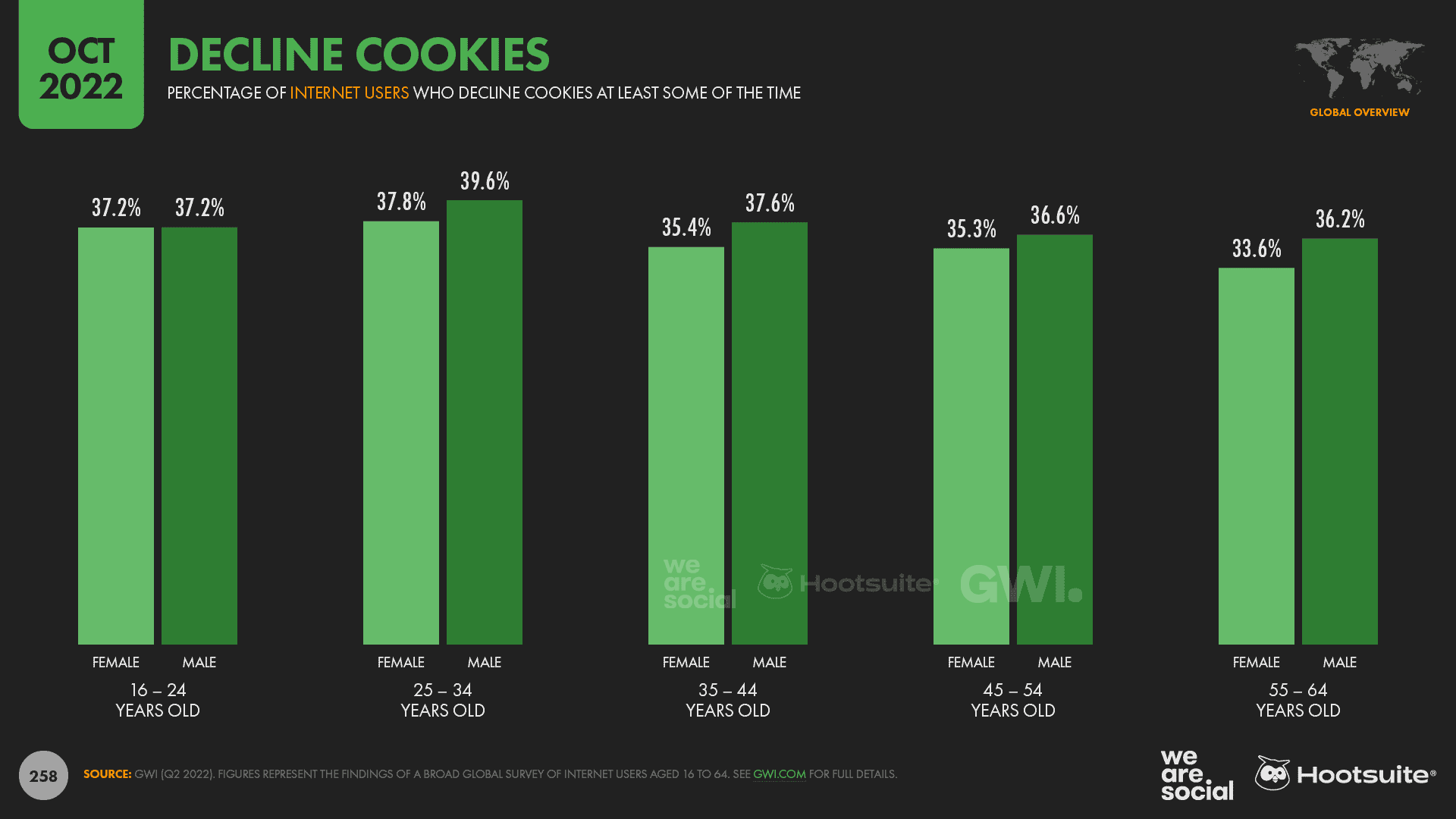

Interestingly, however, attitudes towards cookies remain relatively consistent across age groups and genders, with younger users only slightly more likely to reject cookies than their parents’ generation.

Women are slightly less likely to reject cookies too, although the differences between men and women are minimal.

So what do these numbers tell us?

Well, despite collective hand-wringing by regulators in Europe, and ongoing industry debates around the legitimacy of cookies, it seems that most internet users don’t actually care.

Indeed, the data shows that – even when given the choice—fewer than 4 in 10 of us take active steps to protect our privacy against these online trackers, suggesting that most people simply click “accept all”, and move on.

That’s not to say that digital platforms and marketers shouldn’t be doing more to protect people’s privacy of course, but this data does suggest that regulators and the media may be making a bigger deal out of cookies than public opinion might warrant.

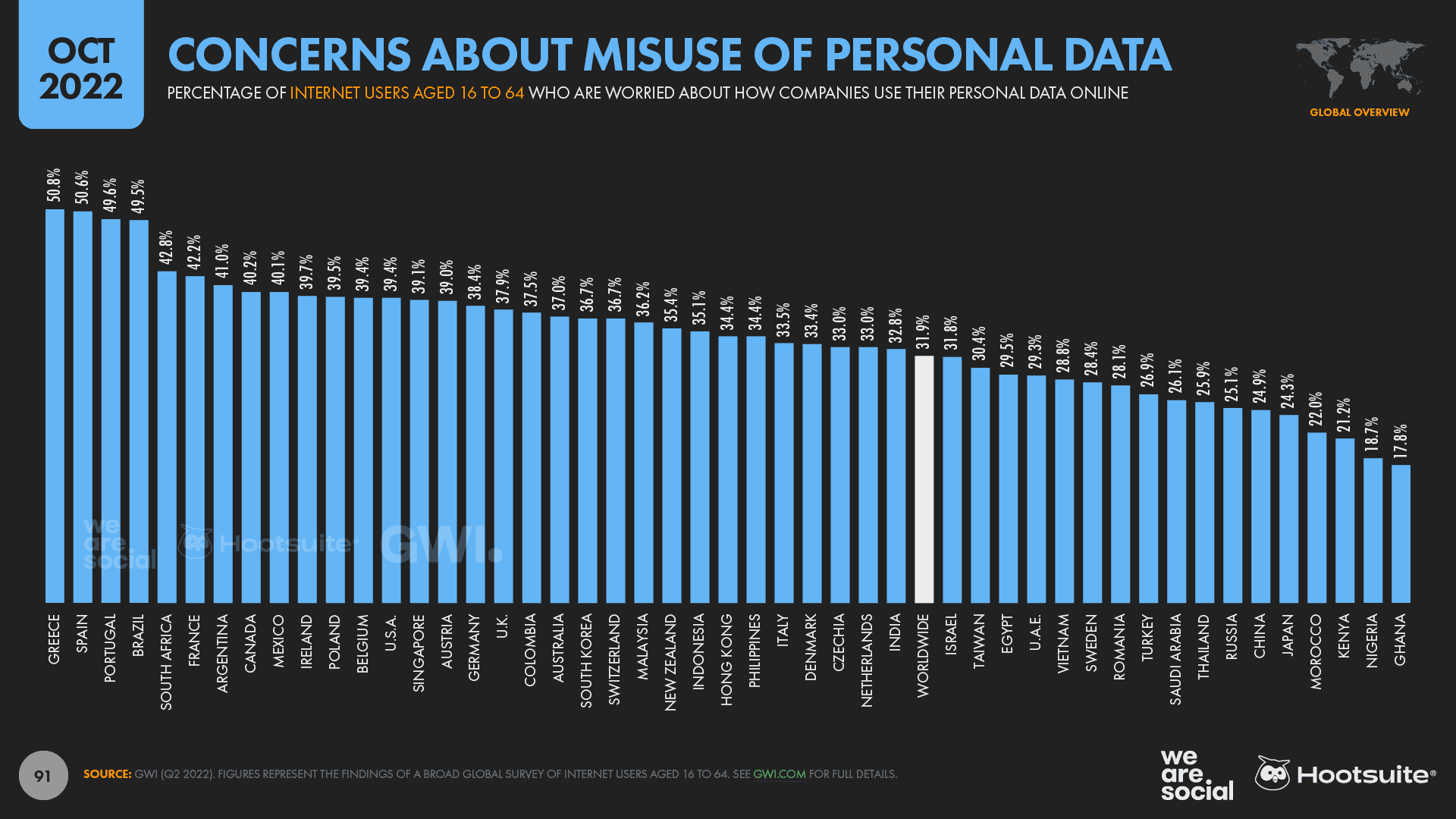

And there’s more data to support this hypothesis in GWI’s research too, with fewer than 1 in 3 working-age internet users saying that they worry about how companies might use their personal data online.

Discover the latest data and insights on social media, the internet, mobile, and other digital behaviors in the Digital 2022 Report.

Important notes on data changes

Major source “corrections” in social media ad reach figures: since our July 2022 report, Meta appears to have begun revising the ways it calculates and/or reports potential audience reach. Notes in the company’s ad planning tools suggest that these revisions are ongoing, but the figures that these tools now report for ad reach across Facebook, Instagram, and Messenger are already meaningfully lower than the figures that the same tools reported just a few months ago. We’ll explore these changes in more detail below, but please note that—as always – the latest figures for these platforms may not be directly comparable with similar figures published in our previous reports.

To learn more about other changes that may impact the comparability of data across reports in the Global Digital Reports series, please refer to our comprehensive notes on data.