Things are changing fast in financial services, from the rise of crypto to the growth of the fintech app category to the development of robo-advisors. As financial services becomes a more digital industry, social media marketing is becoming a more critical means of promotion in the space.

Even if your organization leans more traditional, social media is a necessary channel to reach younger clients. And you need to be prepared for what’s coming. Gartner found 75% of financial services leaders expect significant changes in the industry by 2026.

Here’s why (and how) to build a financial services social media strategy this year.

Download a free bundle of social media tools for financial services — including post ideas and templates for social media policies, strategies, and reports.

Download now1. Reach new audiences

Social media is where Gen Z goes in search of financial information. The oldest members of this age group are turning 25 this year. And they’re starting to hit major milestones that deserve financial advice. 70% of them are already saving for retirement.

Nearly a quarter of 16-to-24-year-olds already use a financial services website or app every month. Ten percent of them already own some form of cryptocurrency.

Source: Hootsuite Global State of Digital 2022 (April Update)

Even if you’re not marketing to Gen Z, social media is an important channel for connecting with new clients. More than three-quarters (75.4%) of internet users use social media for brand research.

2. Strengthen relationships

Building relationships is a key use of social media for finance industry professionals. When it comes to money, everyone wants to deal with someone they know and trust.

Nurturing prospects and clients online is known as social selling. Here’s a quick primer on how it works:

Social media can help identify important financial moments in clients’ and prospects’ lives. For example, LinkedIn is a great place to learn about career changes or retirements. Following clients’ business pages can also give you insight into their challenges.

That said, social selling is usually about building relationships. Sales are a longer-term goal.

When a connection gets a new job or launches a new business, by all means, send a congratulations message. (Nearly 95% of advisors who use social media effectively use some form of direct messaging.)

Keep yourself top of mind. But don’t jump in and try to make a sale.

It’s important to focus on providing trustworthy information and resources. Nearly a quarter of Internet users follow a brand they’re considering purchasing from on social networks. They want to follow and observe for a while before jumping in.

Focus on the client’s needs rather than making the sale.

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

3. Highlight brand purpose and build community trust

Financial services brands now have to show they’re about more than financial returns.

64% of respondents to the 2022 Edelman Trust Barometer survey said they invest based on beliefs and values. And 88% of institutional investors “subject ESG to the same scrutiny as operational and financial considerations.”

Younger investors are particularly interested in sustainable investing. A Harris Poll for CNBC showed that a third of millennials, 19% of Gen Z, and 16% of Gen X “often or exclusively use investments focused on ESG (environmental, social, and governance) factors.”

And a Natixis report found that 63% of millennials believe they have a responsibility to use their investing to help resolve social issues.

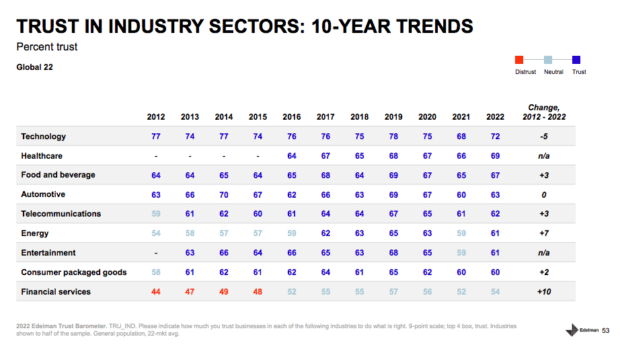

Trust in the financial services sector has grown over the last 10 years. But it’s still the least trusted industry according to the Edelman Trust Barometer. Social media allows you to build trust and address client concerns.

Source: 2022 Edelman Trust Barometer

4. Humanize your brand

People want to deal with trusted financial experts. That doesn’t mean they want their financial services providers to be clinical and cold. Social media provides a great opportunity for you to humanize your brand.

Getting your company’s executives on social media can be a great place to start. After all, it can be easier to trust a person rather than an institution.

Potential clients expect to see your C-suite executives on social. 86% of financial publication readers say it’s important for business leaders to use social media. They trust leaders who use social media more than those who don’t by a ratio of 6 to 1.

Of course, the tone you take will depend on the network you’re using and the target audience you’re trying to reach.

The average advisor uses 4 social networks, with the most successful using 6. The Putnam Social Advisor Survey 2021 found a shift from LinkedIn to Facebook. Advorsors are also inceasingly using Instagram and TikTok.

5. Gain key industry and customer insights

Try using social media for financial services industry research. This is a good way to stay on top of what’s happening in your field.

Does a competitor have a new product offering? Is there an impending PR disaster? Think of social media as an early warning system.

Social media listening can tell you what’s happening in the industry. Here’s how it works:

You can also use social listening to learn about your potential customers and gauge what they want from you.

Also, be sure to keep an eye on your social media analytics. These tools give you insights into the effectiveness of your own social efforts. You can learn what works best. Then, refine your social media marketing strategy for financial service customers as you go.

6. Reduce effort and costs

Social efforts work best when teams, departments, and individual advisors use social media in a coordinated way. Most likely, this involves a shared social media management platform.

A content library is a valuable resource for both employees and brands. Staff has access to pre-approved, compliant content that’s ready to go. Brands have peace of mind when employees post consistent messaging that supports strategic goals.

When everything is housed in one central library, there’s no duplication of effort or expense. This pre-approved library addresses financial advisors’ top two concerns about using social media:

- Lack of time

- Fear of making a mistake.

7. Provide unified digital customer service

As the financial industry becomes increasingly digital, customer service needs to follow suit. Customers want to reach out to businesses on the platforms where they already spend their time. That might mean social networks like Facebook or social messaging apps like WhatsApp.

Social customer service tools allow you to coordinate your customer service across all channels. At the same time, you can link conversations to your CRM. This helps ensure you meet compliance requirements for response time as well as record-keeping.

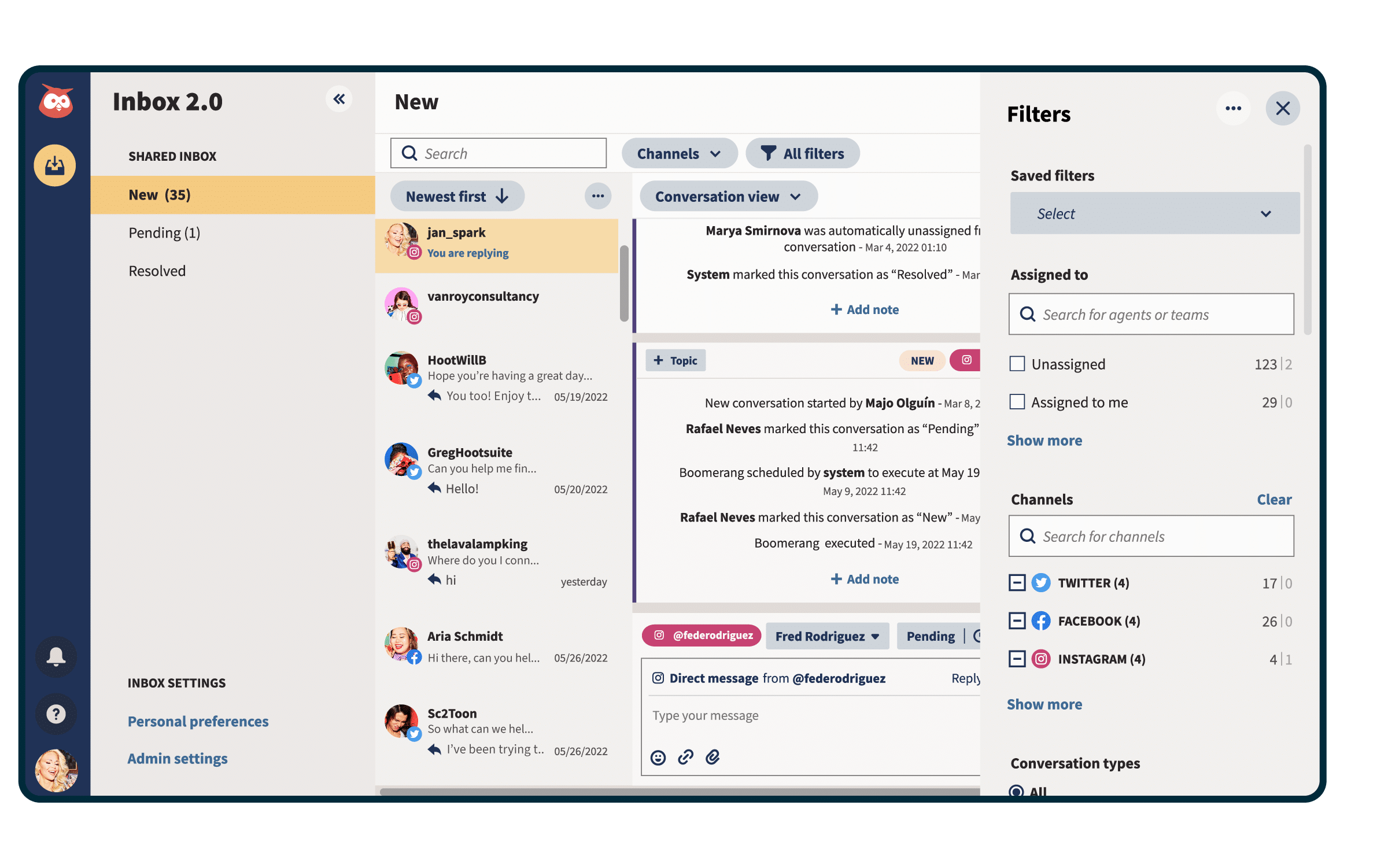

With Hootsuite Inbox, you can bridge the gap between social media engagement and customer service — and manage all of your social media messages in one place. This includes:

- Private messages and DMs

- Public messages and posts on your profiles

- Dark and organic comments

- Mentions

- Emoji reactions

… and more.

The all-in-one agent workspace makes it easy to

- Track the history of any individual’s interactions with your organization on social media (across your accounts and platforms), giving your team the context needed to personalize replies

- Add notes to customers’ profiles (Inbox integrates with Salesforce and Microsoft Dynamics)

- Handle messages as a team, with intuitive message queues, task assignments, statuses, and filters

- Track response times and CSAT metrics

Plus, Inbox comes with handy automations:

- Automated message routing

- Auto-responses and saved replies

- Automatically triggered customer satisfaction surveys

- AI-powered chatbot features

8. See real business results

Put simply, social media affects your bottom line in concrete, measurable ways.

81% of financial advisors who use social media say they’ve gained new business assets through their social efforts. In fact, advisors using social media successfully report an average of $1.9 million in assets gained through social media activities.

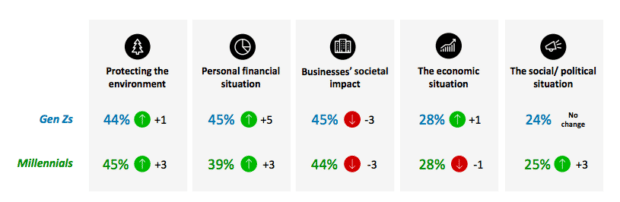

Deloitte’s Global 2022 Gen Z and Millennial Survey found that young people’s optimism about their own financial situations is improving. However, both of these generations are overall still anxious about their financial security.

Source: Mood Monitor Drivers, Deloitte Global 2022 Gen Z and Millennial Survey

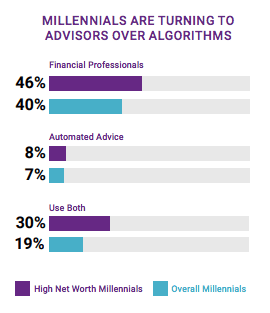

At the same time, the Natixis Global Survey of Individual Investors found that 40% of millennials—and 46% of high-net-worth millennials—want personal financial advice from a financial advisor. Social media is a perfect place to connect with these new clients.

Source: Natixis Global Survey of Individual Investors: Five Financial Truths About Millennials at 40

1. Focus on compliance

FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, GDPR—all the compliance requirements can make your head spin.

It’s critical to have compliance processes and tools in place, especially to guide independent advisors’ use of social media.

Get your compliance team involved as you develop your financial services social media strategy. They’ll have important guidance on the steps you need to take to protect your brand.

It’s also important to have the right chain of approvals in place for all social media posts. For example, FINRA states:

“A registered principal must review prior to use any social media site that an associated person intends to use for business.”

Get a glimpse into the future of financial services on social media and build a strategy you can bank on.

Get the report2. Archive everything

This falls under compliance, but it’s important enough that it’s worth calling out on its own.

According to FINRA: “Firms and their registered representatives must retain records of communications related to their “’business as such.’”

Those records must be kept for at least three years.

Hootsuite’s integrations with compliance solutions like Brolly and Smarsh automatically archive all social media communications. You’ll have your social content stored in a secure and searchable database, complete with the original context.

3. Conduct a social media audit

In a social media audit, you document all your company’s social channels in one place. You also note any key information relevant to each. At the same time, you will hunt down any impostor or unofficial accounts so you can have those shut down.

Start by listing all the accounts your internal team uses regularly. But remember—this is just a starting point. You’ll need to look for old or abandoned accounts and department-specific accounts.

While you’re at it, make note of the social platforms where you don’t have any social accounts. It might be time to register profiles there. (TikTok, anyone?) Even if you’re not ready to use those tools yet, you might want to reserve your brand handles for future use.

We created a free social media audit template to help keep all your research organized as you tackle this work.

4. Implement a social media policy

A social media policy guides social media use within your organization. That includes accounts for your advisors and agents.

Reach out to all the relevant teams within your organization, including:

- Compliance

- Legal

- IT

- Information security

- Human resources

- Public relations

- Marketing

All these teams should have input. This will help you maintain a consistent brand identity while reducing compliance challenges.

Your policy will also define team roles and approval structures so everyone understands the workflow of a social post. This clarity upfront can help reduce frustrations that social media might not move as quickly as some would like.

Using social media for finance industry purposes can also come with security risks. Include a section in your social media policy that outlines security protocols for the less-sexy aspects of social media. For example, prescribe how often to change passwords and how often software should be updated.

Download a free bundle of social media tools for financial services — including post ideas and templates for social media policies, strategies, and reports.

Download now1. Current x MrBeast

Current is a financial services company that primarily offers mobile banking services through an app. To build brand awareness, they partnered with high-profile influencers including Hailey Bieber and Logan Paul.

I offered a military squad $100,000 if they could successfully hunt me down in a day, GO WATCH THE NEW VIDEO!

— MrBeast (@MrBeast) December 10, 2021

In particular, they developed an ongoing collaboration with the influencer MrBeast. Two of the resulting social videos reached the number 1 top trending video spot on YouTube. As a result of the campaign, Current saw a 700% increase in money requests through the app and became the number 5 finance app in the Apple App Store.

2. BNY Mellon #DoWellBetter

BNY Mellon developed a campaign to highlight the positive impacts of their high-net-worth clients. Featuring beautiful portraits and video interviews, the campaign showed how sound investing and wealth management through BNY Mellon allowed them to build the resources to effect positive change.

Telling client stories is a good way for financial institutions to create a human connection on social media platforms.

3. CloudTax influencer campaign targeting Gen Z

This Canadian tax software startup partnered with several influencers. They mainly used TikTok to reach a Gen Z audience. Founder and CEO Nimalan Balachandran told Global News influencer marketing drove around a quarter of the company’s growth.

Their influencer videos embraced the unique TikTok look and feel. This allowed them to connect with the platform’s community in a way that wouldn’t be possible through more traditional social content.

@passionstoprofits #taxseason #taxwriteoffs #taxwriteoff #taxes2021 #payyourtaxes #moneytok #smallbusinesscheck #smallbusinesstips_ #smallbusinessowner #cloudtaxpartner ♬ Runaway (U & I) – Galantis

4. Vanguard Group #GettingSocial

Investment company Vanguard Group uses a weekly series of social videos to share expertise on investing and other financial topics.

Releasing the videos on a consistent schedule trains followers to expect the content. This encourages viewers to check back weekly and become regular watchers over time. The videos offer short, snackable insights. They don’t require a large time commitment from busy followers.

They also run social ads that speak to similar topics. This exposes social users to educational and conversion-oriented content that work in concert.

5. Penn Mutual: Content library for advisors

Penn Mutual has a dedicated content studio within its marketing department. They produce, test, and refine social content that forms the backbone of a content library for advisors.

The social team adjusts content to make it appropriate for various audiences. Then they add it to the content library for financial advisors to customize and share. They use Hootsuite Amplify to make the process of sharing possible with just a few clicks or taps.

The company sends a list of new content every Friday, which advisors can then post or schedule.

https://www.facebook.com/justingmillerfinancialadvisor/posts/1005269093302126

Hootsuite makes social marketing easy for financial service professionals. From a single dashboard, you can manage all your networks, drive revenue, provide customer service, mitigate risk, and stay compliant. See how the tool can work for your business.

Get more leads, engage customers and stay compliant with Hootsuite, the #1 social media tool for financial services.

Book a Demo

![Graph: Use of online financial serviced by age group and gender [Hootsuite Global State of Digital 2022 (April Update)]](https://blog.hootsuite.com/wp-content/uploads/2022/05/social-media-for-financial-services-3-620x316.png)